Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Mantle is focused on building a sustainable hub for onchain finance by combining institutional-grade infrastructure with blockchain technology. At the heart of Mantle is its ~$2.3 billion community-owned treasury, which actively funds innovative products and fosters the growth of ecosystem partners. Mantle drives financial utility and liquidity through core products like Mantle Network, mETH Protocol, Function, and MI4, enabling the development of solutions that enhance sustainable yield, deep liquidity, and composability across DeFi.

Mantle Network (MNT) is built using OP Stack Bedrock. The network has integrated EigenDA on mainnet and is slated to fully integrate Succinct’s SP1 to further enhance user security. The EVM-compatible network employs an optimistic rollup mechanism to batch multiple transactions into a single transaction on the Ethereum mainnet. Mantle Network aims to offer lower gas fees, reduced latency, and higher throughput than Ethereum. The project’s ecosystem primarily consists of restaking, gaming, DeFi, and NFT-related protocols, which its large community-owned treasury anchors. Mantle’s treasury catalyzes asset partner growth, paving the way for protocols such as Ethena USDe, Ondo USDY, Agora AUSD, and EigenLayer restaking to provide enhanced yield options and liquidity solutions. Mantle Network aims to be the “liquidity chain” to drive capital efficiency in the onchain economy through modular architecture, data availability solutions, and zero-knowledge proofs.

Mantle’s other core innovation pillars include:

Website / X (Twitter) / Discord

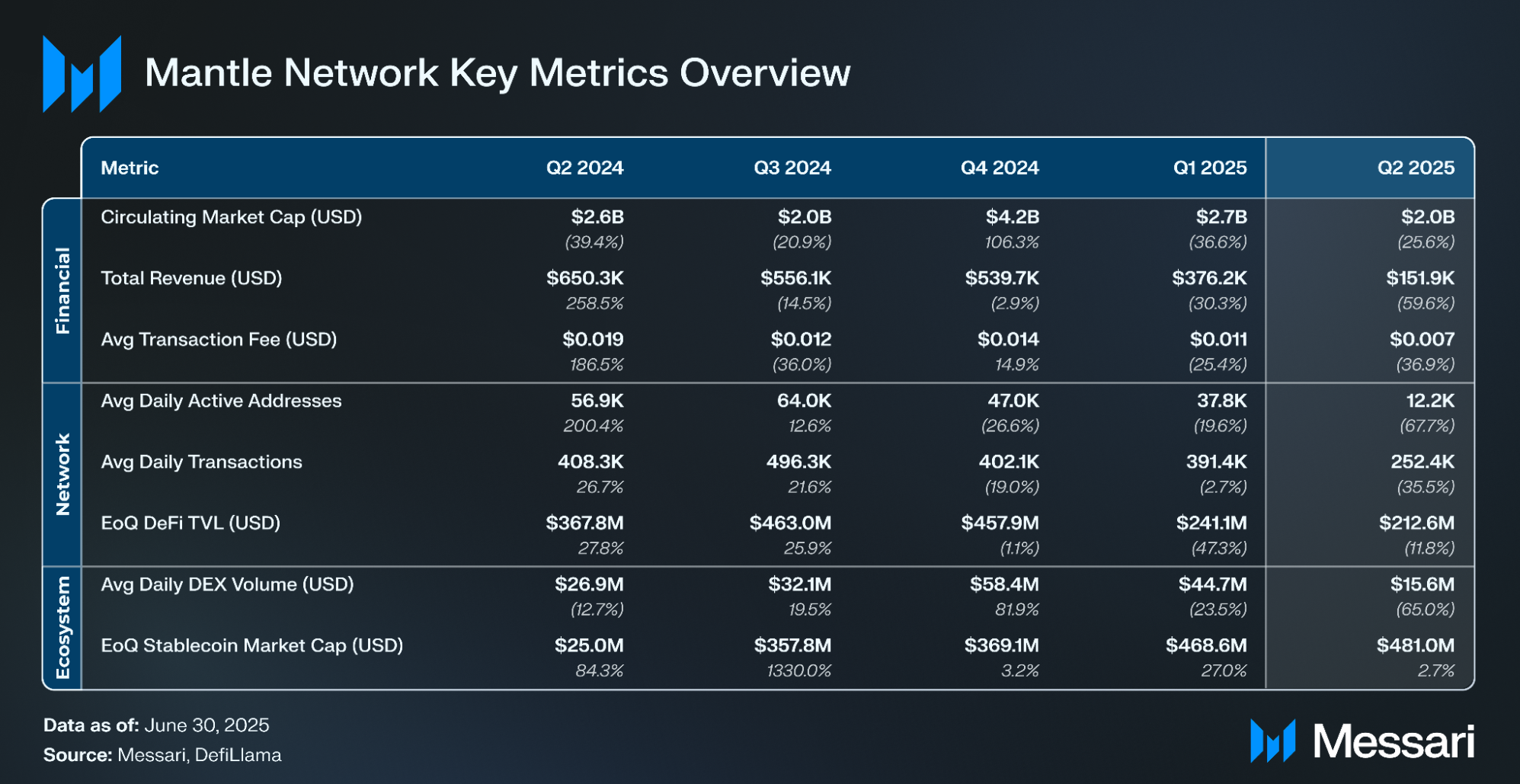

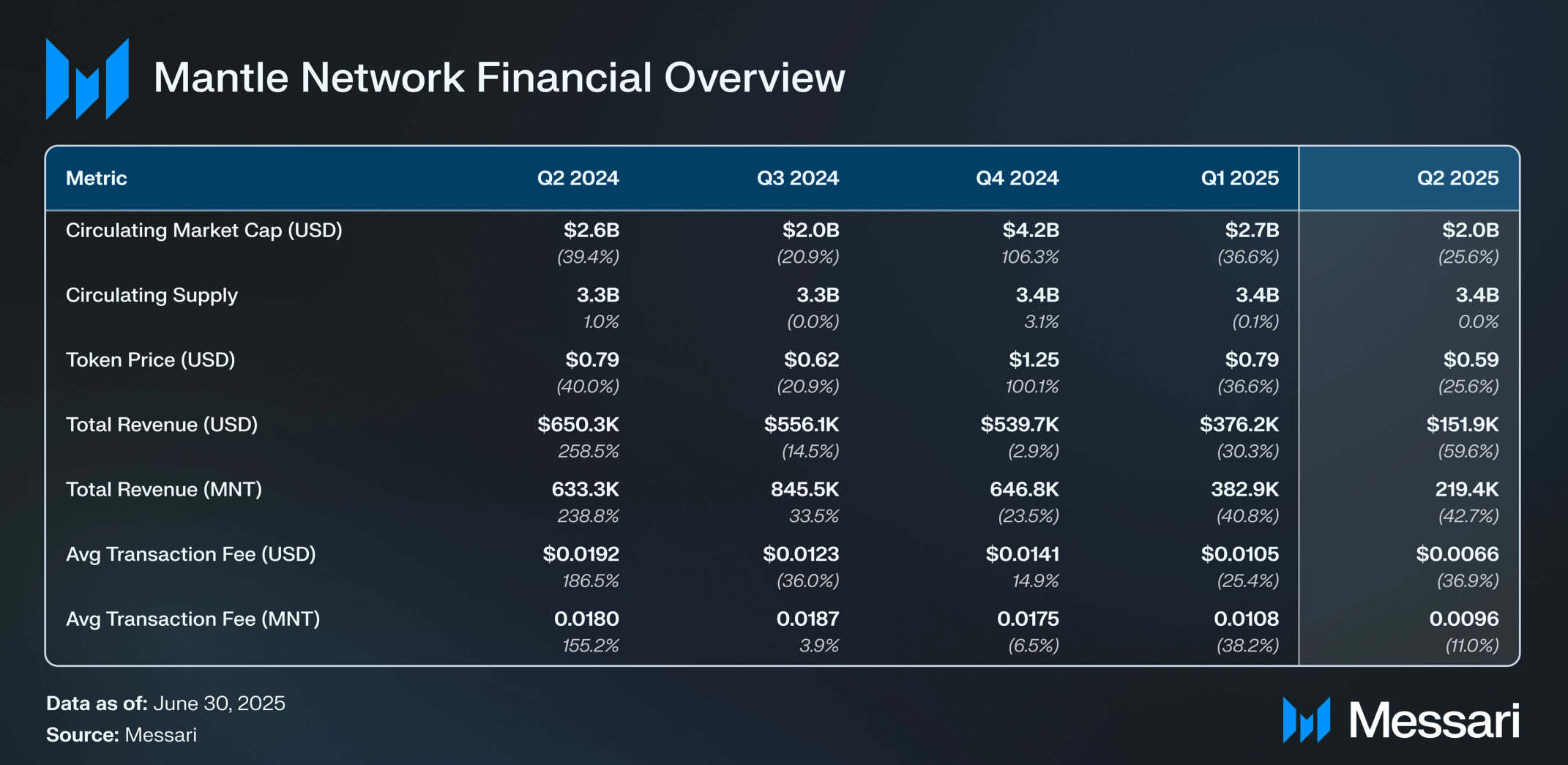

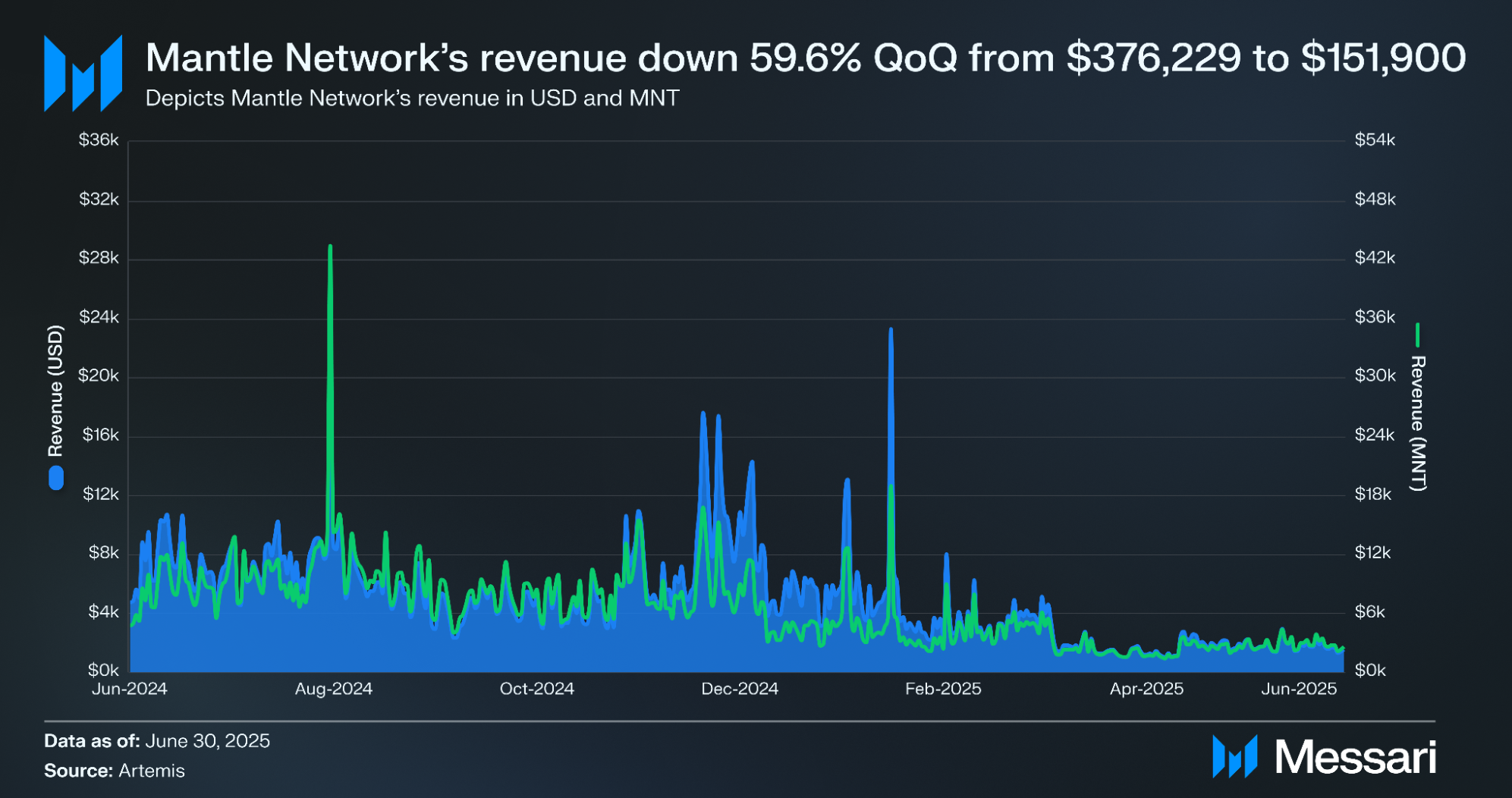

In Q2 2025, MNT’s circulating market cap decreased 25.6% QoQ, from $2.7 billion to $2.0 billion. Similarly, the price of MNT decreased 25.6% QoQ, from $0.79 in Q1 to $0.58 in Q2. Mantle’s total revenue also declined 59.6% QoQ from $376,229 to $151,900.

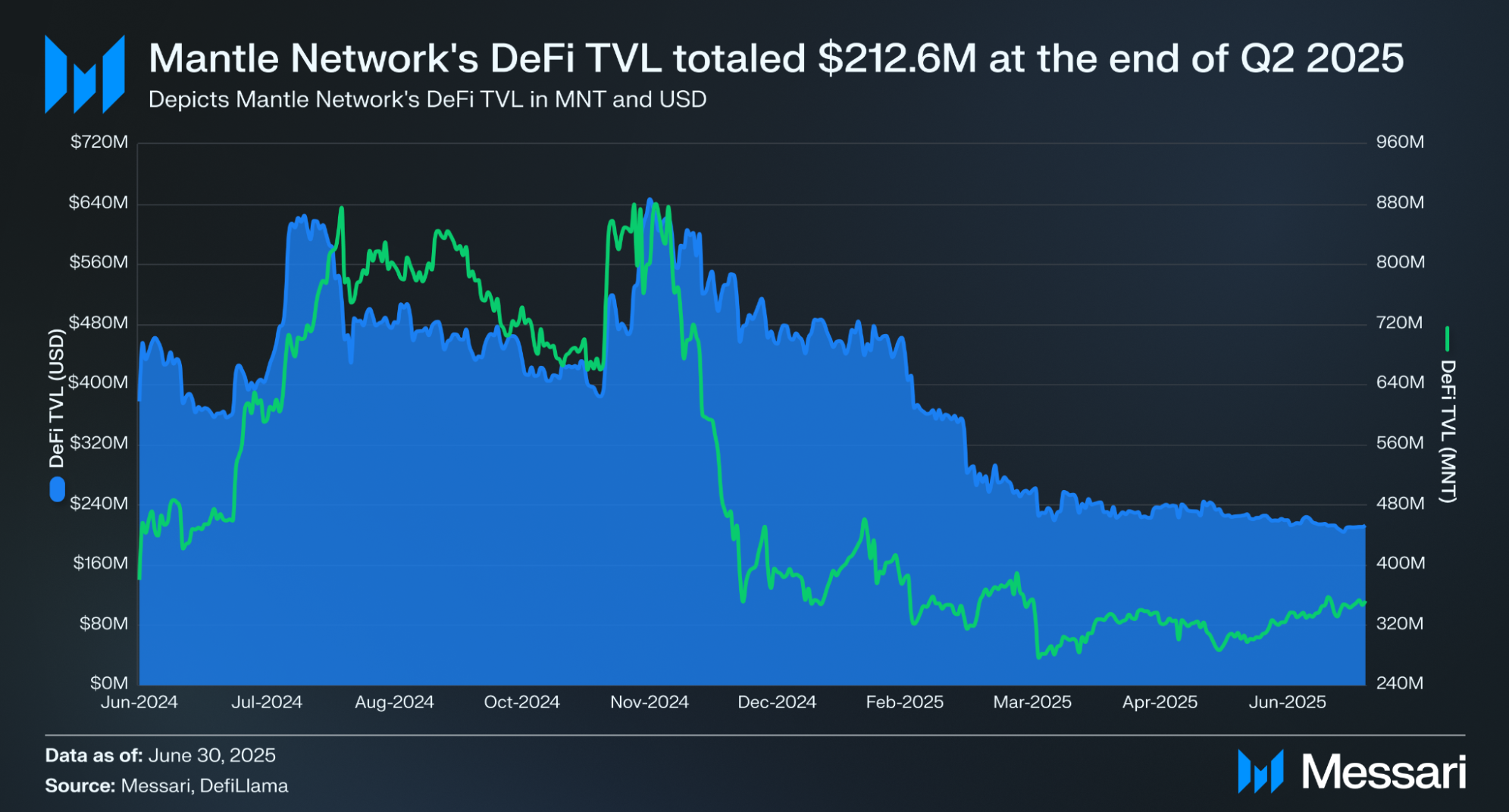

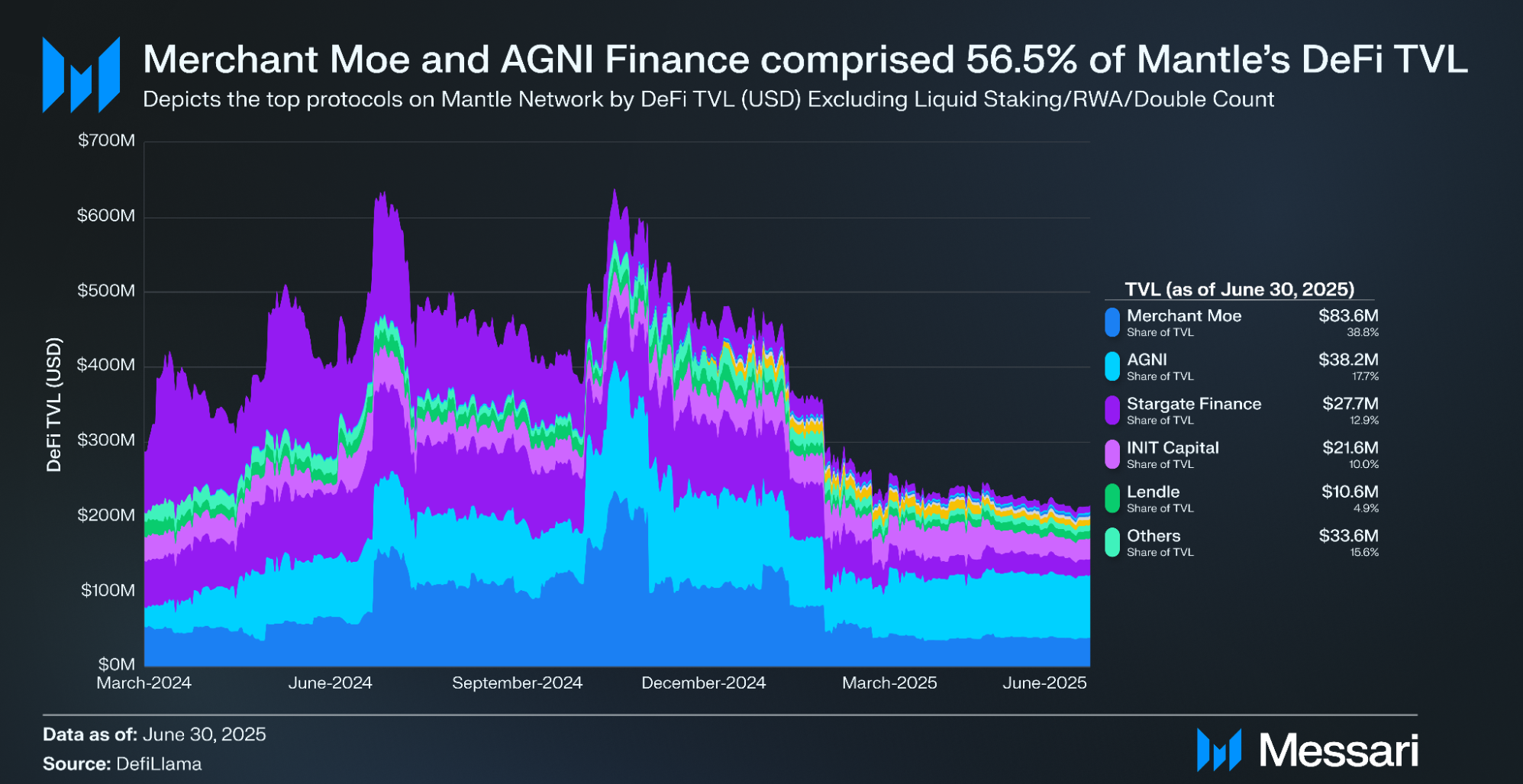

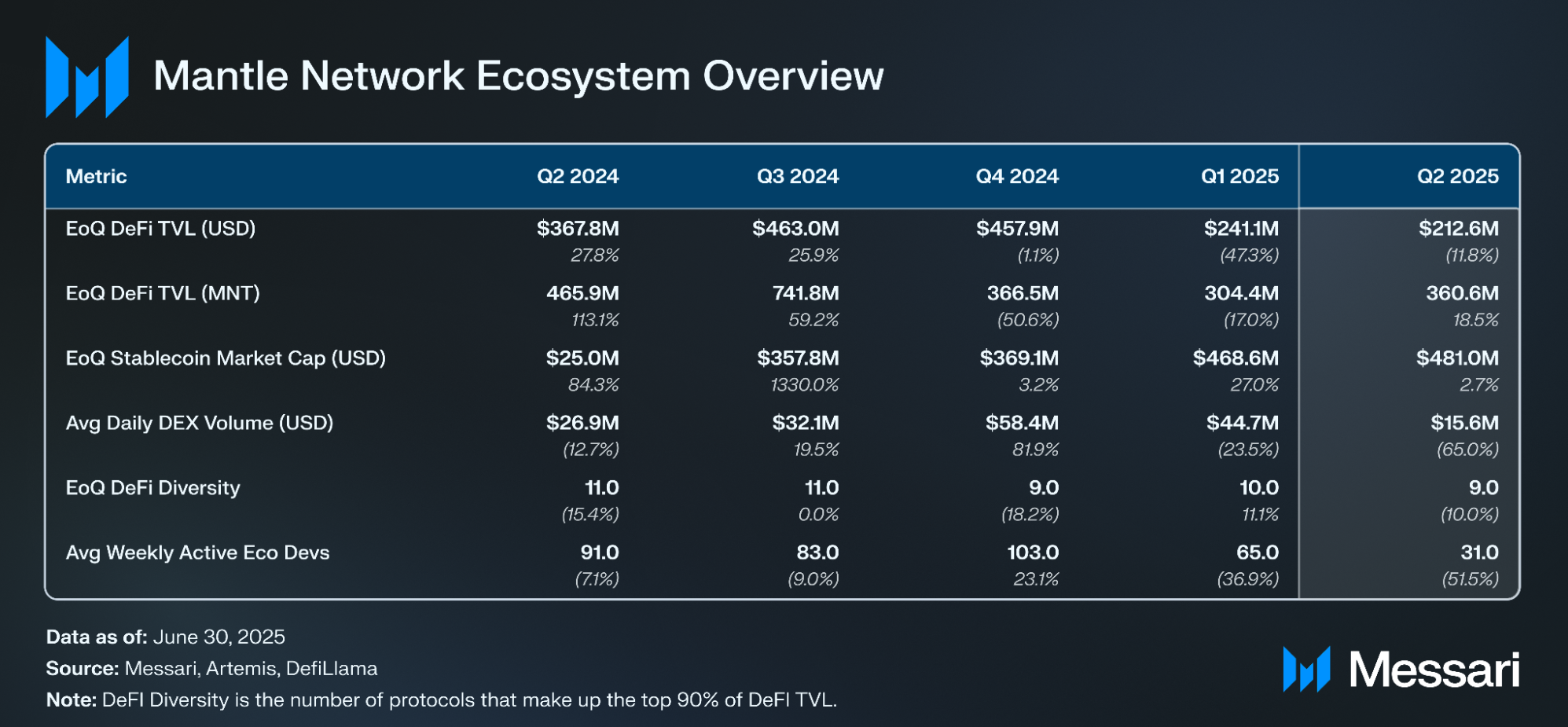

As of June 30, 2025, Mantle Network’s DeFi ecosystem is led by a small group of protocols that comprise the majority of locked onchain value. Merchant Moe and AGNI Finance accounted for 56.5% of Mantle’s DeFi TVL in Q2, holding $83.6 million (38.8%) and $38.2 million (17.7%), respectively. Stargate Finance followed with $27.7 million (12.9%), while INIT Capital held $21.6 million (10.0%), and Lendle captured $10.6 million (4.9%). The remaining protocols in the “Others” category, consisting primarily of mETH Lab, Omega, PumpBTC, and IntentX, contributed $33.6 million (15.6%).

Notably, Mantle’s mETH Protocol and Function (FBTC) continued to bolster the network’s ecosystem TVL during Q2. At quarter’s end, mETH Protocol recorded a TVL of $939.1 million, reflecting its role as a liquid staking and restaking solution focused on Ethereum-native yield strategies. Function, Mantle’s BTC-based yield product, ended the quarter with a TVL of $1.5 billion, entirely backed by BTC. The protocol continues to gain traction as a high-liquidity, cross-chain Bitcoin instrument. TVL figures represent an uptrend from prior lows, and both protocols remain foundational to Mantle’s broader architecture and driving onchain adoption.

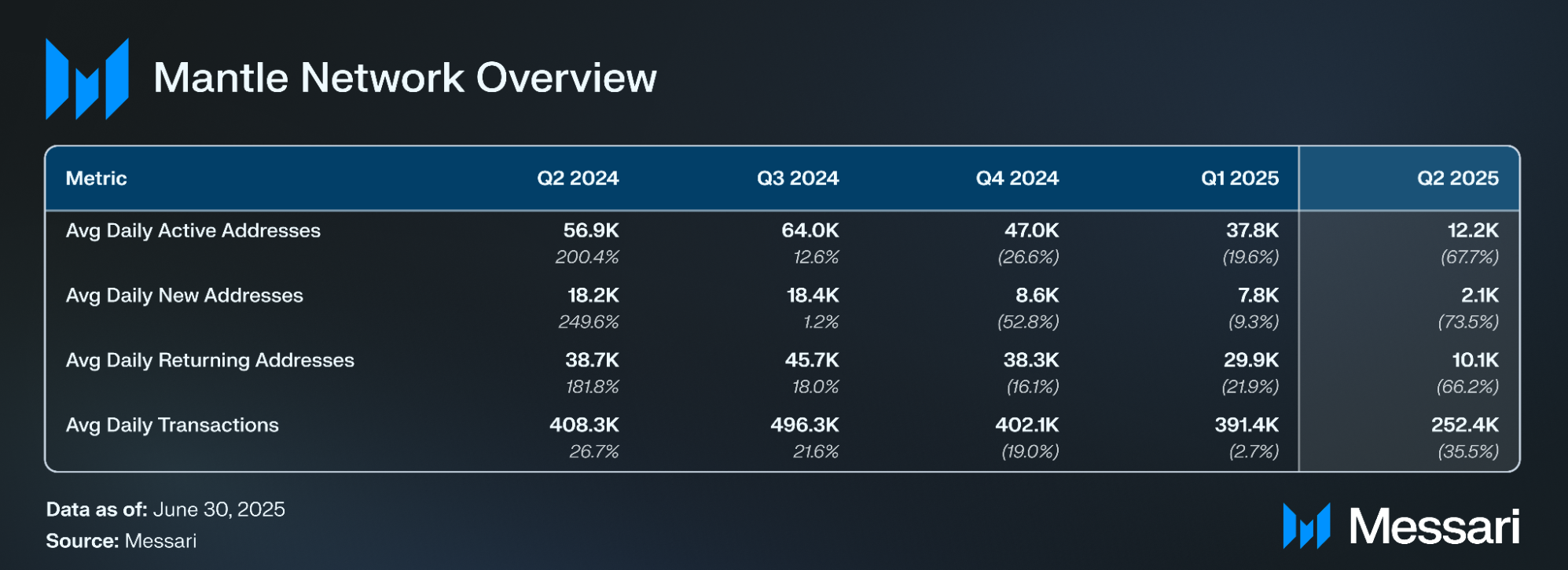

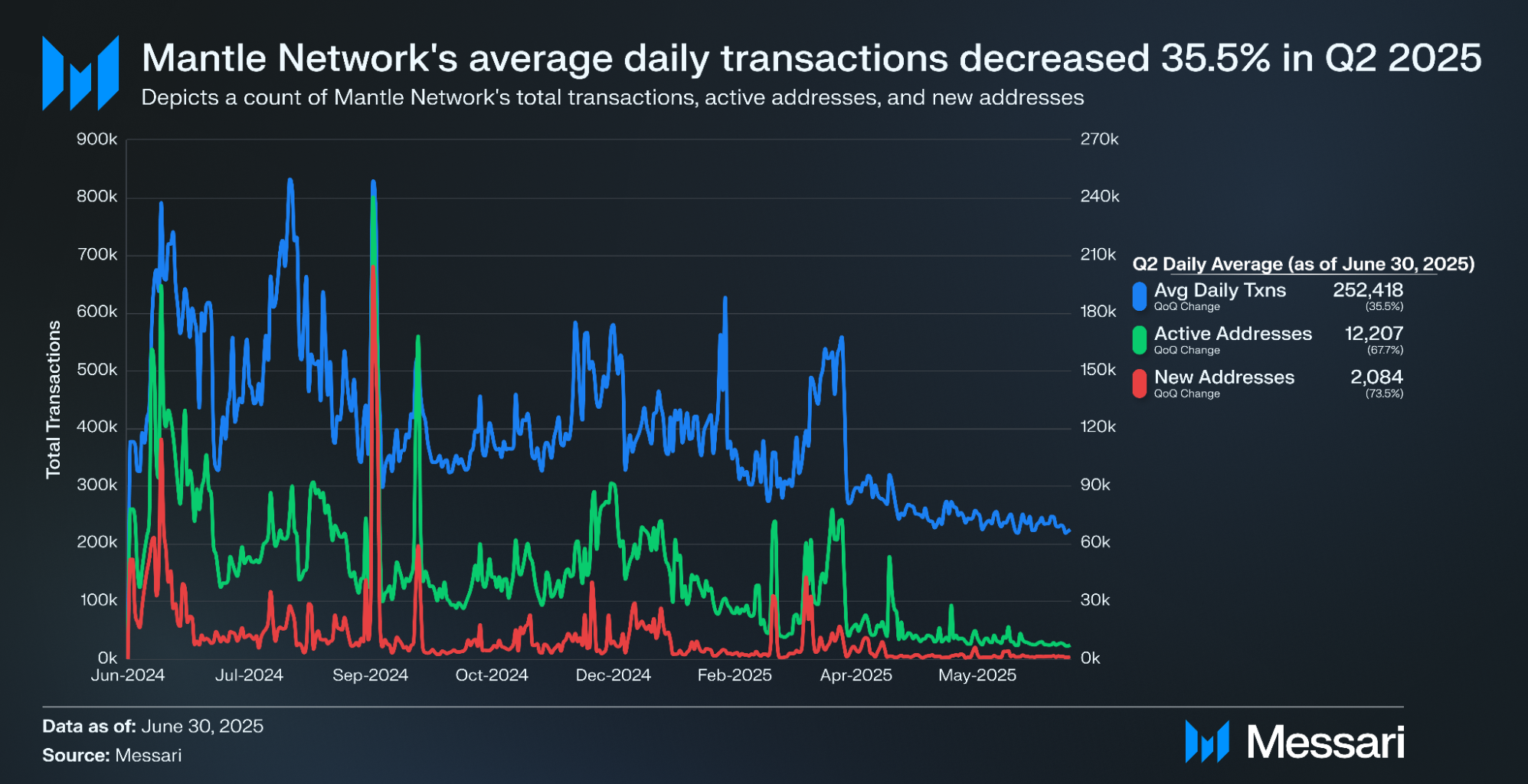

In Q2 2025, Mantle Network’s average daily transaction count decreased by 35.5%, from 391,398 in Q1 to 252,418 in Q2. The protocol recorded an average of 12,207 daily active addresses, declining 67.7% QoQ from 37,815 in Q1. The protocol also recorded an average of 2,084 daily new addresses in Q2, a 73.5% QoQ decrease from the 7,877 average in Q1. Lastly, Mantle Network’s average daily returning address count decreased by 66.2% QoQ, from 29,938 to 10,123 addresses.

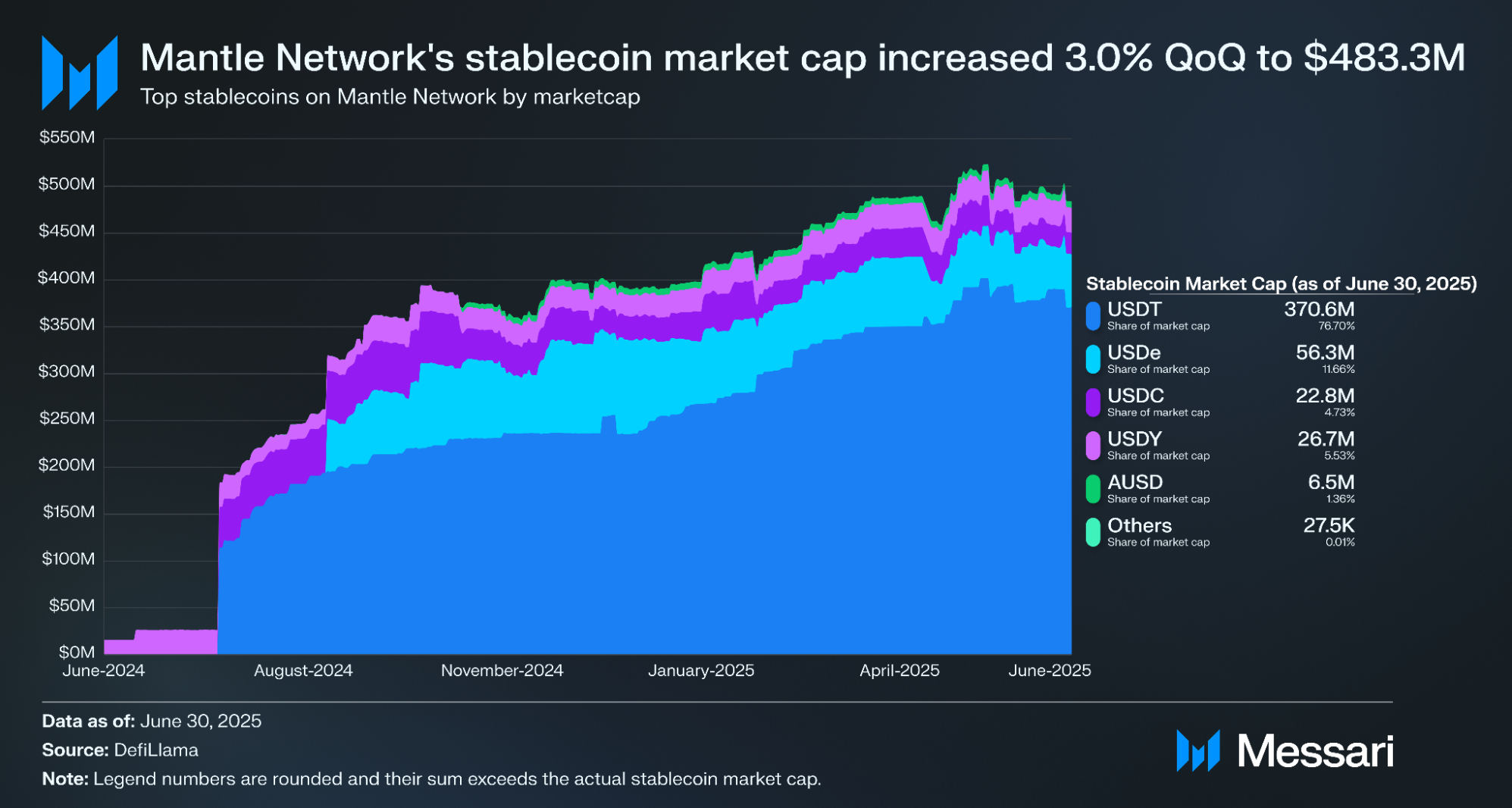

Q2 2025 represented a period of ecosystem maturation for Mantle, with a strategic emphasis on vertical integration and the “Blockchain for Banking” narrative. Launches of consumer-oriented products and institutional funds, alongside infrastructure upgrades, reinforced Mantle’s role in bridging TradFi and DeFi. Mantle Network’s stablecoin market cap increased 3.0% QoQ from $468.6 million in Q1 to $483.3 million in Q2. This strengthening was primarily reflected in the market cap of USDT, which comprised 76.7% of the total stablecoin market cap in Q2. This growth signals rising demand for stable, onchain liquidity within the Mantle ecosystem.

Mantle Network continued its evolution into a purpose-built platform for onchain banking services, underpinning UR and advancing the “Blockchain for Banking” category through modular enhancements. The network fully integrated EigenDA on mainnet, delivering 234x bandwidth expansion to 15 MB/s throughput, over $335 million in security via 163,020 mETH restaked through EigenLayer, and 20x improved censorship resistance with over 200 operators. This supports scalable, decentralized data availability that is aligned with Ethereum’s security.

OP-Succinct progressed on the Sepolia testnet, transitioning Mantle toward a ZK validity rollup. Leveraging Succinct’s SP1 zkVM for proof generation, the Mantle Succinct Proposer for ZK state submissions to Ethereum, and the Kona Engine for Rust-based transitions, the upgrade enables asset interoperability, faster finality (reducing withdrawals from seven days to under one hour), cryptographic security, and EVM equivalence. It also incorporates developments like RETH and REVM for up to 2x performance over Geth, facilitating high-volume use cases like RFQ-based trading and RWA platforms.

The Rewards Station’s Booster Season 3, launched July 8, 2025, offers 1.2 million MNT over three months, with a time-weighted MP formula rewarding longer locks. Across seasons, 3.7 million MNT has been distributed. The Kaito Yapper Leaderboard also advanced Phase 1 and Phase 2, allocating 100,000 MNT to top contributors for content creation.

Additional ecosystem efforts included the Lightning Grants program for rapid builder funding and collaborations, like the HyperEVM integration for cmETH deployments.

Mantle soft-launched UR in beta during Q2, with early access beginning June 18, 2025, inviting select contributors to test features ahead of a full public rollout in mid-Q3. UR (pronounced “You Are”) is positioned as a comprehensive onchain financial app, providing a unified account for fiat and stablecoins to simplify spending, saving, and investing across crypto and fiat. Key features include a Swiss-backed multi-currency account (EUR, CHF, USD, RMB with 1:1 backed deposits), a Mastercard debit card for global merchants, and access to banking rails like SWIFT, SEPA, and SIC, alongside crypto networks such as Ethereum and Arbitrum for seamless on and off-ramps.

UR embodies “Blockchain for Banking,” blending TradFi usability with blockchain programmability and trust, while unifying Mantle’s focus on payments, trading, and assets like MI4, mETH Protocol, and FBTC. Supported by ecosystem incentives, the Rewards Station, and Bybit Launchpool, UR settles all transactions on Mantle Network, accruing value to MNT holders. Phased expansions planned for Q3 include fiat-to-crypto on-ramps, native yield on idle balances, mobile apps for iOS and Android, and broader network support, positioning UR as a gateway for mainstream adoption in over 40 countries.

MI4 launched as an institutional-grade tokenized fund, with Mantle Treasury committing up to $400 million as an anchor investor following DAO approval. Partnered with Securitize, the tokenization provider for BlackRock’s BUIDL, MI4 offers diversified exposure to BTC (50%), ETH via mETH (29%), SOL via bbSOL (6%), and stablecoins (15%), with quarterly rebalancing and yield enhancement through DeFi strategies. Targeting $1 billion assets under management (AUM), MI4 enables tokenization of fund interests on Mantle Network for private secondary trading and collateral use, compliant with U.S. accredited investor and non-U.S. person requirements. At $191 million AUM, MI4 ranks as Securitize’s fourth-largest tokenized fund.

Mantle also pledged strategic support for ReserveOne, an institutionally governed crypto reserve inspired by the U.S. Bitcoin stockpiles, with partners like Galaxy Digital and Coinbase. This aligns with RWA efforts, enabling staking via Function (FBTC), mETH Protocol, and bbSOL.

Q2 2025 marked a validation phase for mETH Protocol, shifting its narrative to institutional adoption as a vertically integrated staking and restaking solution. Across custody, capital markets, and DeFi, confidence solidified, positioning mETH and cmETH as reliable assets for Ethereum’s yield layer allocators.

mETH became the first LST on a public company’s balance sheet, allocated via Republic Technologies, and gained support from OSL, Hong Kong’s licensed custodian. It was designated a core yield driver in MI4, enhancing ETH exposure.

cmETH holdings on Bybit grew 25.5% to ~81,000 tokens, while supply on HyperEVM surged 750.0% to over 1,900 tokens. The cmETH Fixed Yield Vault reached its 30,000 cmETH cap (over $80.0 million) in its first month.

Entering Q3, the focus shifts to expansion and distribution for broader accessibility in capital flows. Early initiatives include (i) a restaking campaign with EigenLayer and Bybit offering high APRs on Onchain Earn, (ii) explorations of real-world integrations such as with UR, and (iii) NounsDAO’s Proposal 818, which delegated 1,000 ETH (over 20% of their treasury) to mETH.

mETH Protocol anchors Mantle’s onchain finance stack, delivering Ethereum-native, bank-grade infrastructure for capital and yield, helping to support the blockchain for banking vision.

Rebranded from Ignition FBTC in February 2025, Function transforms Bitcoin into a capital-efficient, hyperliquid asset. TVL reached $1.6 billion, with deployments across EVM-compatible chains like Berachain and Sonic, and goals to expand to non-EVM chains like Solana and SUI.

In July 2025, Function announced a $10.0 million seed round, with participation from Galaxy Digital, Antalpha, and Mantle. Galaxy’s support contributes to liquidity, governance, and risk frameworks, enabling FBTC to serve institutional treasuries with full custody and 1:1 backing by BTC.

MantleX, the AI research and incubation arm behind Mantle, advances initiatives at the AI-blockchain intersection, focusing on research, thought leadership, and non-dilutive support for AI-native teams. Publications include “Overview of LLMs,” as a primer on large language models for decentralized ecosystems, and “Agents in DeFi,” exploring AI optimization of DeFi strategies. AI avatars and animations serve as brand mascots, demonstrating generative AI use.

Two AI product teams are developing (i) agentic yield optimization with one-click strategy execution and (ii) AI verifiability tooling for stronger trust. Launches are planned for Q3. They are targeting agentic yield optimization and one-click strategy execution while exploring AI verifiability for trust in core use cases. This advisory model prioritizes collaboration without equity, enhancing ecosystem engagement and education.

In partnership with HyperPlay Gaming, Mantle hosted the Mantle Games Fest from April 24, 2025, to May 21, 2025, featuring six Web3 games to showcase blockchain gaming on the network. The event structured activities across four weeks, with leaderboards resetting weekly to encourage participation:

Each game allocated 50,000 MNT in rewards, totaling 300,000 MNT. These were supplemented by exclusive in-game items, NFTs, Mystery Boxes, and a separate 30,000 MNT Discord airdrop for video-on-demand engagement.

Participants accessed games via HyperPlay’s multichain launcher (compatible with Windows, Mac M1+, and Android), integrating crypto wallets for onchain rewards, challenges, and purchases. Key mechanics included incentivized play earning Stardust and MNT tokens, NFT staking for reward boosts, competitive rankings (e.g., damage, guilds, landmarks), refunds for beta purchases, and post-event data resets (except retained rewards). HyperPlay Quests served as the central hub for progress tracking, while community feedback via Discord and X (Twitter) supported ongoing development.

Winners’ award claims were processed through HyperPlay from May 29 to June 12. A raffle distributed an additional 5,000 MNT to five players on June 30. Engagement extended beyond Q2 with a surprise seventh game, Age of Dino (strategy survival title), launching on July 14 for 30 days, offering 75,000 MNT and 30,000 Dino Eggs exclusively via HyperPlay.

The fest underscores Mantle’s expansion into gaming, capitalizing on its low-fee, high-throughput infrastructure to stimulate onchain activity, attract developers, and diversify beyond DeFi applications.

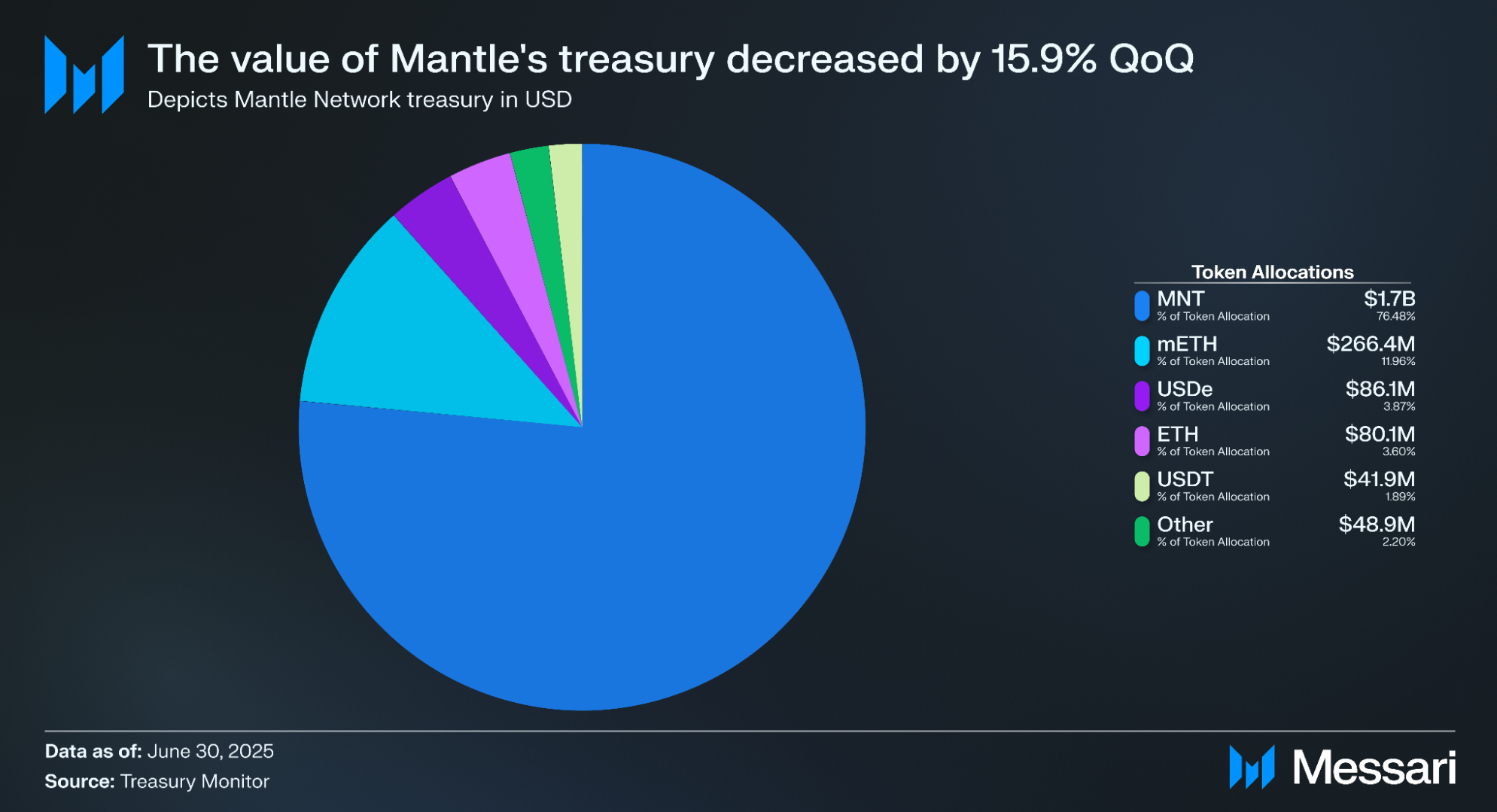

In Q2 2025, Mantle’s total treasury holdings denominated in USD decreased from $2.6 billion to $2.3 billion, reflecting a 15.9% QoQ decline. MNT accounted for 76.5% of the total treasury holdings ($1.7 billion). The second-largest allocation was mETH, representing 12.0% ($266.4 million), followed by USDe at 3.9% ($86.1 million). Other notable positions included ETH (3.6%, $80.1 million), USDT (1.9%, $41.9 million), and a combination of USDC and sUSDe (2.2%, $48.9 million). The updated distribution underscores Mantle’s continued reliance on its native token for treasury value while maintaining moderate diversification across Ethereum-based assets and select stablecoins.

According to DefiLlama, Mantle’s treasury ranked second among all protocols at quarter’s end.

Mantle’s circulating market cap fell 25.6% QoQ, decreasing from $2.7 billion in Q1 2025 to $2.0 billion in Q2 2025. Mantle advanced its position among competing protocols, prioritizing vertical integration and the “Blockchain for Banking” narrative in Q2.

Products such as the mETH Protocol and Function remained central to the network’s architecture, closing the quarter with $939.1 million and $1.5 billion in TVL, respectively. Despite declines in network usage metrics, incentive programs, including the Mantle Rewards Station Booster Season 3, Kaito Yapper Leaderboard Phase 1 and Phase 2, Lightning Grants, and the Mantle Games Fest contributed to sustained onchain activity and community engagement.

Technological advancements, including full EigenDA mainnet integration and OP-Succinct testnet progress with RETH/REVM enhancements, reinforced Mantle’s modular infrastructure roadmap and set the stage for Q3 2025 upgrades like EigenDA v2 and ZK rollup deployment. With the beta launch of UR, MI4’s institutional fund debut, and MantleX’s AI initiatives positioning the ecosystem as a full-stack platform for onchain finance, Mantle advances with a clear trajectory toward mainstream adoption and deepened relevance in bridging TradFi and DeFi.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Mantle. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.