Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Key Insights

Sei (SEI) is a general-purpose Layer-1 network that combines the best of Ethereum and Solana. Specifically, the developer tooling, mindshare, and network effects of the Ethereum Virtual Machine (EVM), with the performance and scalability of high-performance networks like Solana. For a full primer, refer to our Initiation of Coverage report.

Sei launched in August 2023 alongside SEI, its native token that serves functions related to (i) transaction fees, (ii) staking, (iii) rewards, and (iv) governance. Sei V1 was based on the Cosmos SDK and Tendermint Core protocol. The network’s built-in features, such as Twin-Turbo Consensus and transaction parallelization, reduce latency and increase throughput.

The Sei V2 upgrade introduced three major upgrades to the network in May 2024: (i) compatibility with Ethereum Virtual Machine (EVM) smart contracts written in Solidity, (ii) optimistic parallelization, and (iii) a re-architecture of the network’s storage interface with SeiDB. For a full primer, refer to our Initiation of Coverage report. In the future, Sei plans to launch Giga, an upgrade that aims to include a new EVM client that offers a 50x improvement in throughput.

Website / X / Discord / Telegram

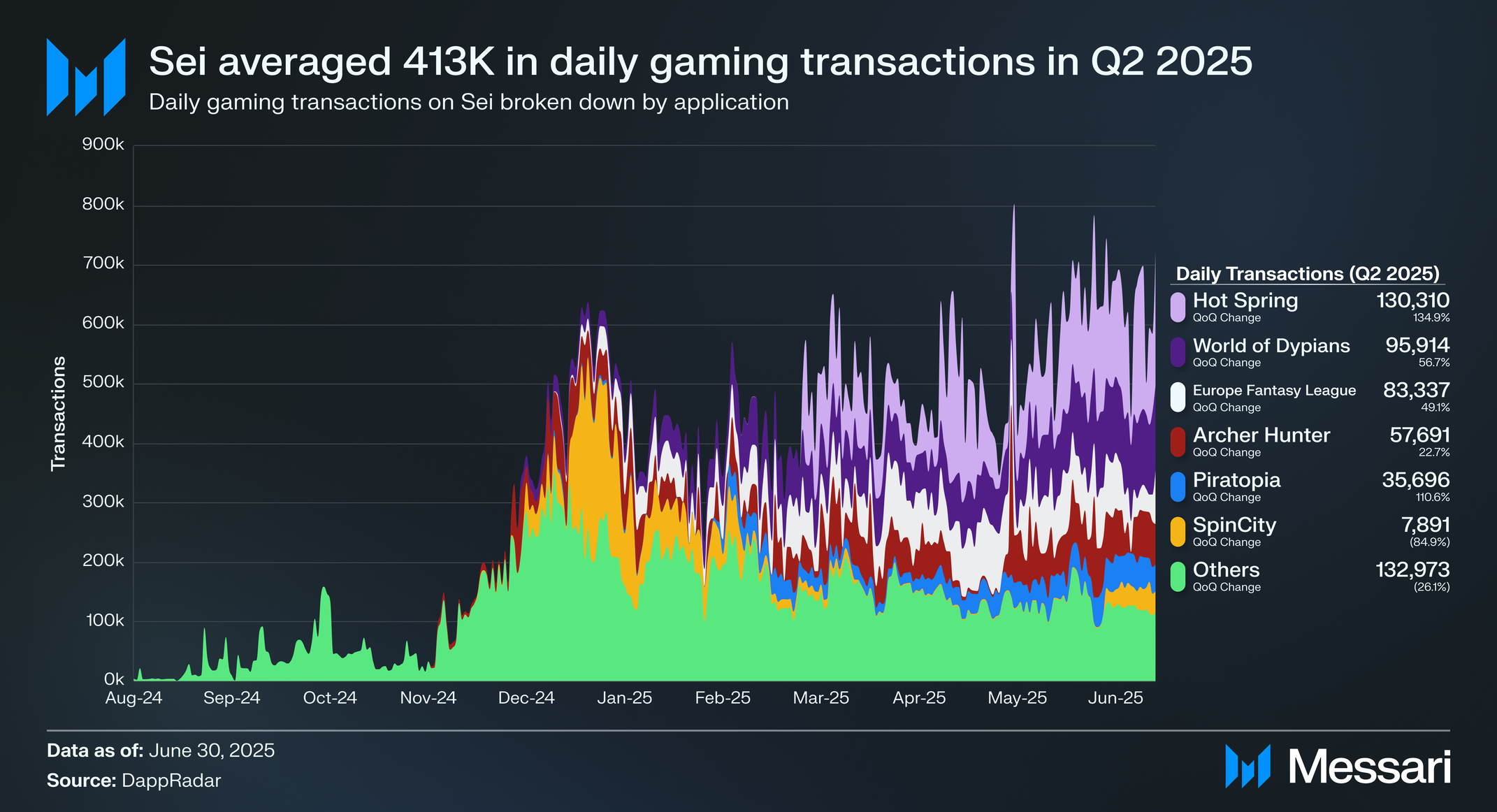

Sei’s gaming ecosystem continued to thrive in Q2 2025, reaching a total of 49.5 million gaming-related transactions, an increase of 24% from 39.9 million in Q1’25. World of Dypians continued to be a standout but was overtaken by Hot Spring in terms of transactional activity.

Other notable gaming ecosystem highlights include projects like Europe Fantasy League, Piratopia, SpinCity, Kawaii Puzzle, Sugar Senpai, Empire of SEI, DragonLand, Sacred Tails, Helium Wars, Sunnyside Acres, FishWar, Quizmatch, Dragon Slither, Seiyara, Capy vs Monsters, Cat VS Monsters, Astro Karts, Grand Gangsta City, Dawnshard, Arcade Galaxy, Zombies of Arcadia, and more.

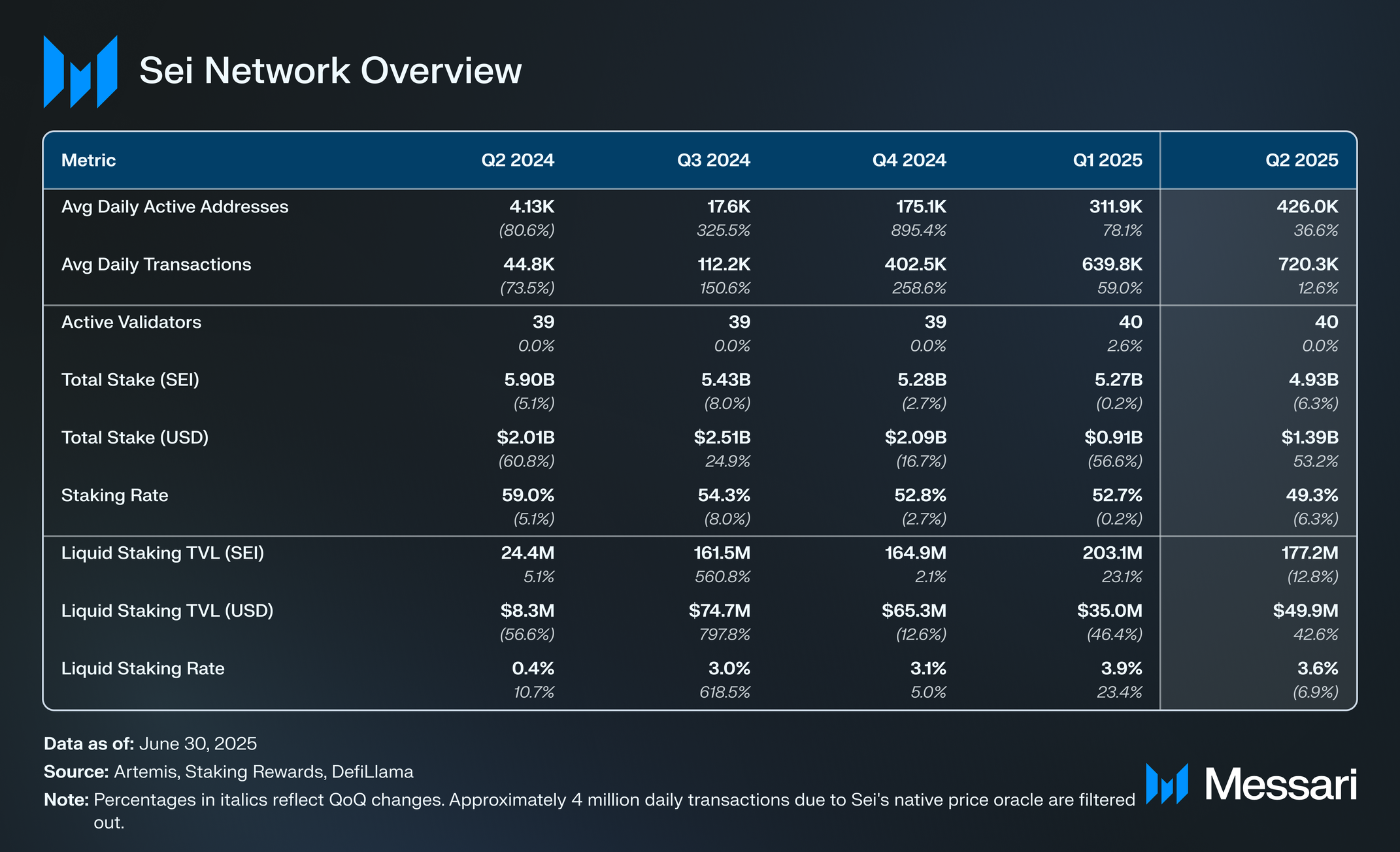

All in all, Sei’s gaming sector has been a major contributor to network activity growing for a fourth straight quarter in Q2’25, with average daily active addresses (DAAs) up 36.6% QoQ to 426,000 and average daily transactions up 12.6% to 720,300.

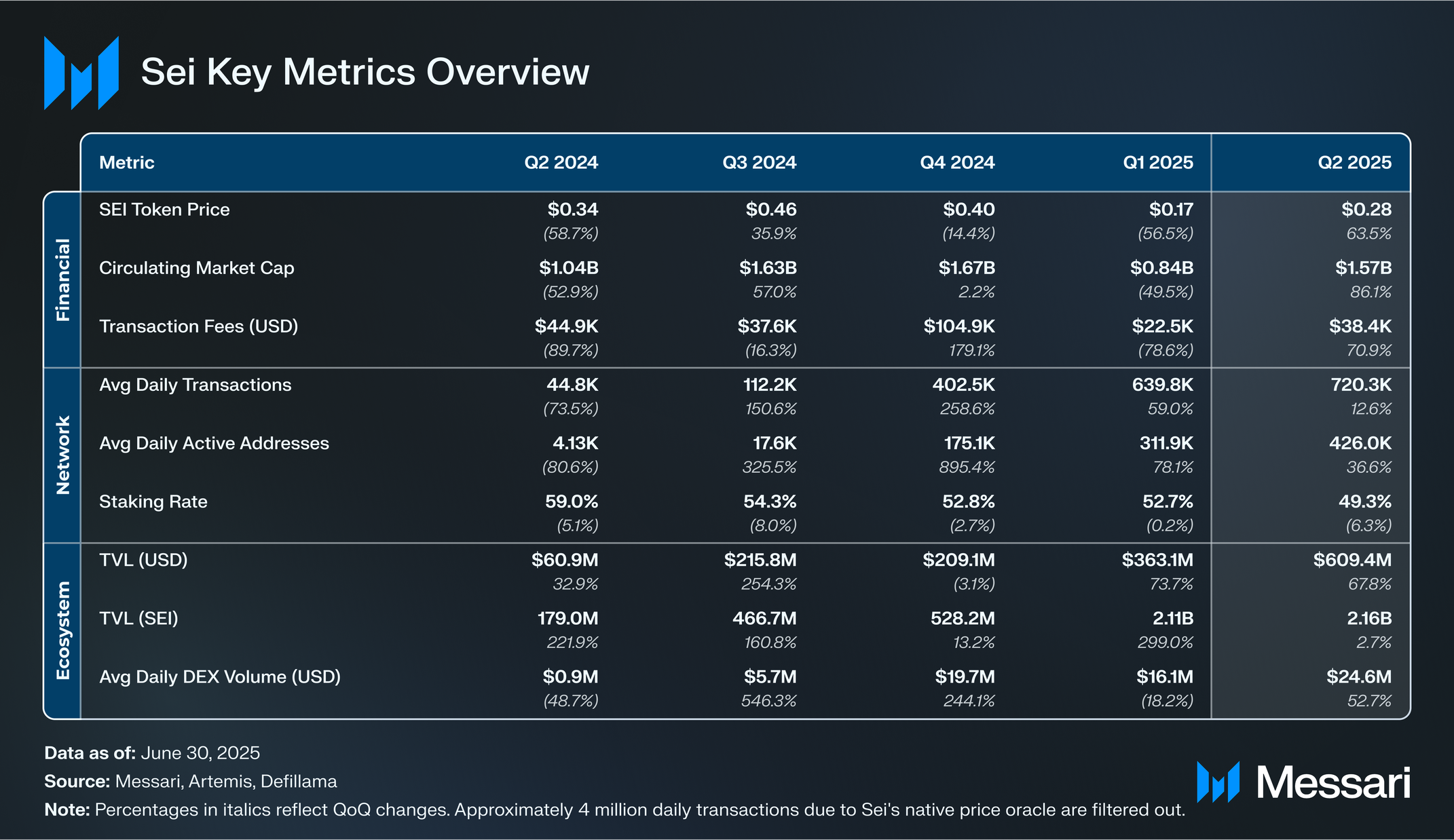

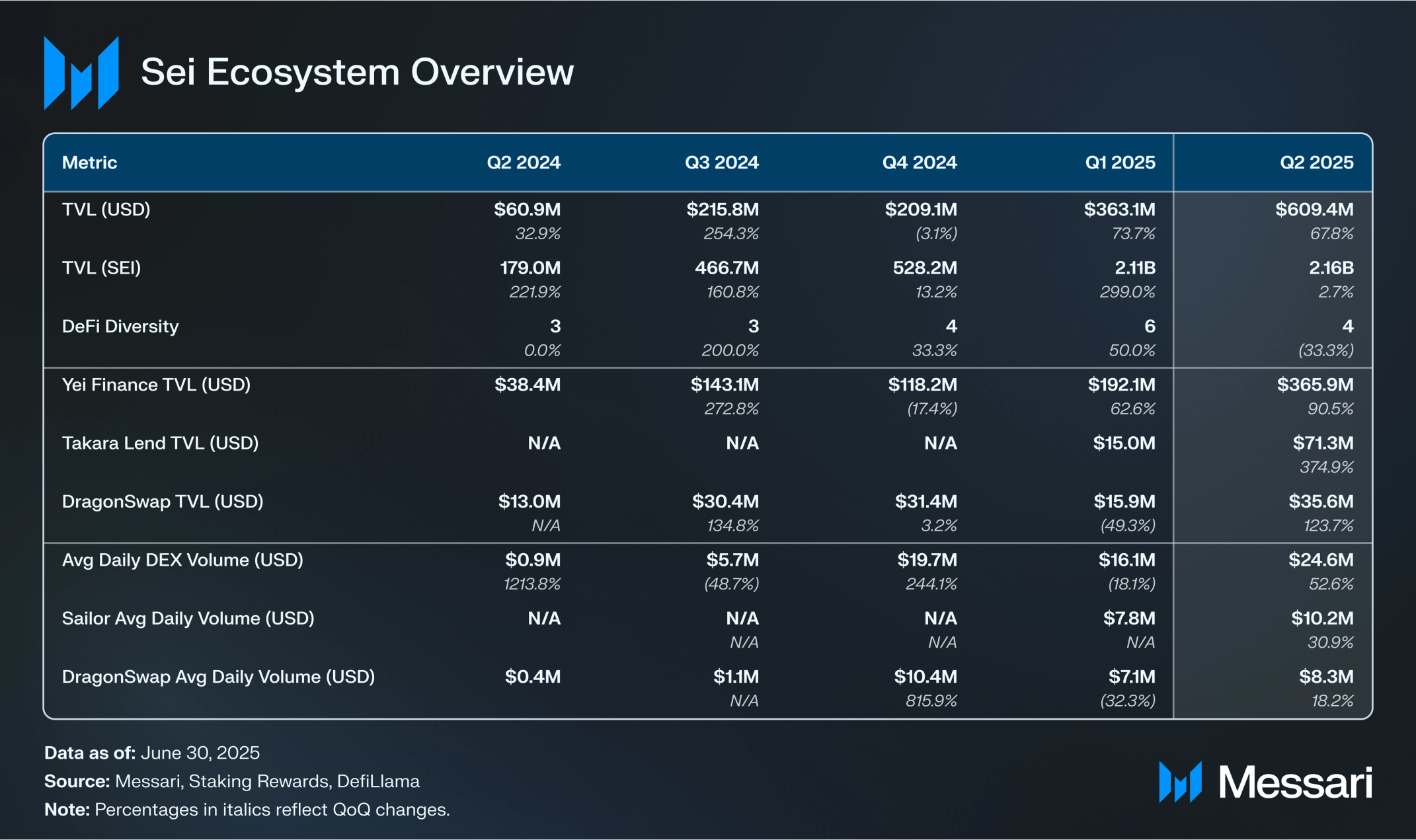

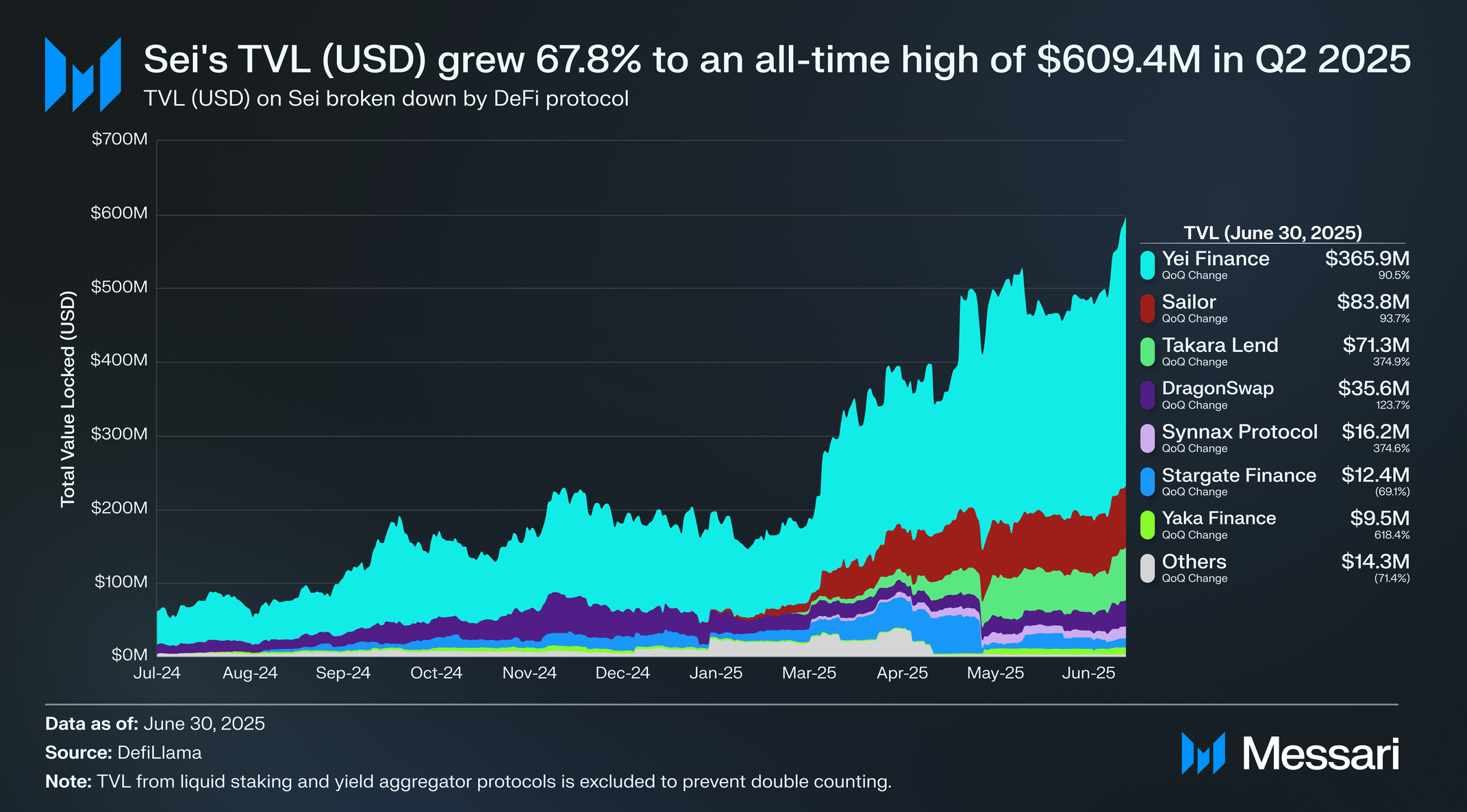

Over a year has passed since the launch of Sei V2, which introduced EVM compatibility in May 2024 and kick-started Sei’s DeFi ecosystem. In Q2 2025, TVL (USD) grew for a second straight quarter, increasing 67.8% QoQ to an all-time high of $609.4 million. With SEI’s price increasing 63.5% QoQ to $0.28 and the token being heavily utilized across Sei’s DeFi ecosystem, TVL (SEI) rose by a more modest 2.6% QoQ to 2.16 billion.

Sei’s DeFi Diversity score (i.e., the number of protocols making up 90% of a network’s TVL) decreased 33.3% in Q2’25, from six to four. This was the first ever contraction, highlighting that Sei’s top DeFi protocols are being cemented and growing more rapidly than smaller protocols.

Sei’s stablecoin market cap (USD) grew to an all-time high of $276.8 million by the end of Q2 2025. This is led by Circle’s USDC, which accounts for 84.5% of all stablecoins on Sei, with $233.7 million as supply grew 54% QoQ. While USDT only accounts for 9.9% of stablecoins on Sei, its supply grew 464.7% QoQ to $27.4 million, spurred by the launch of USD₮0 and migration away from USDT on April 9, 2025.

Circle launched support for native minting and burning, and Cross-Chain Transfer Protocol (CCTP) compatibility on Sei in July 2025. Notably, Circle was an early investor in Sei and currently holds 6.25 million SEI, which was worth $1.7 million at the end of Q2’25.

Stablecoins are a core part of borrowing and lending activity on Sei, which has always been dominated by Yei Finance, and still is. Yei grew again in Q2’25 as the protocol continued a points program that began on June 17, 2024. In May 2025, Yei extended its partnership with Binance Wallet for a third season, offering $1.4 million in incentives through July 2025. The protocol ended Q2’25 with a TVL of $365.9 million, up 90.5% QoQ for a total share of 60.1% of Sei’s TVL.

On May 27, 2025, Yei launched its Yeilians NFT collection, which minted out instantly. Among the first benefits for Yeilians holders was access to Yei’s new product, YeiSwap. On July 3, 2025, Yei launched YeiSwap in beta. Similar to Fluid, YeiSwap increases capital efficiency by allowing lent assets to double as tradeable liquidity, increasing yields for users, who earned badges as beta participants.

Outside of Yei, Takara Lend has grown to become a legitimate competitor. The protocol’s TVL grew 374.9% QoQ to $71.3 million, or 19.5% of Yei’s TVL and 11.7% of Sei’s TVL. In May 2025, Takara partnered with Bitget Wallet to provide $1 million in incentives through August 2025, which led to major TVL growth. Takara also offers an in-app swap feature powered by Symphony Exchange, a DEX aggregator, and an in-app bridge feature powered by DeBridge and LI.FI.

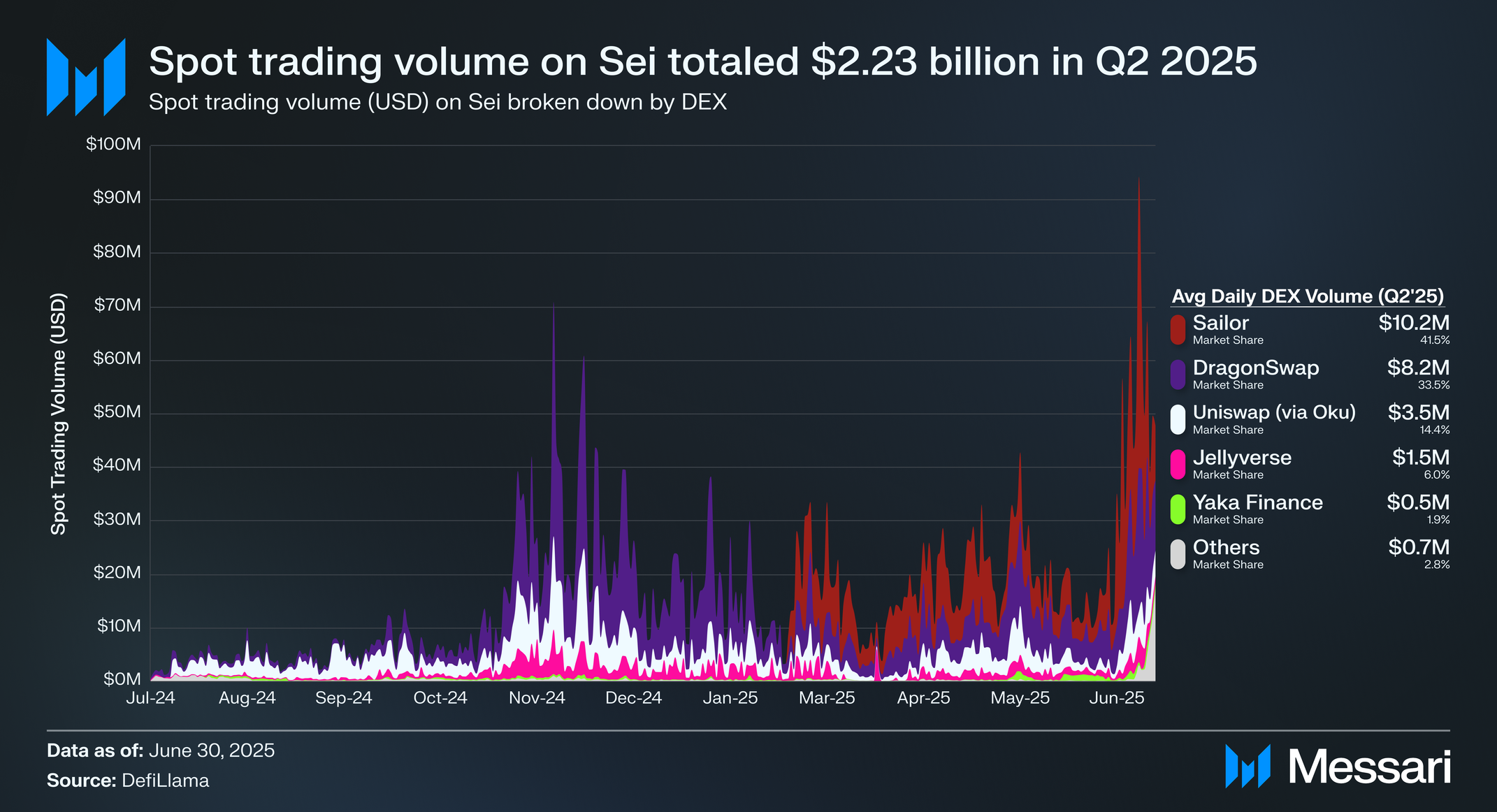

Average daily DEX volume (USD) on Sei increased 52.6% QoQ to $24.6 million and has sustained the elevated levels seen in Q4’24. A major shift in market share over spot DEX volume has taken place in 2025. Sailor leads average daily DEX volume (USD) as the incumbents, DragonSwap and Jellyverse, lost market share relative to Sailor in Q2 2025.

Outside of automated market maker (AMM) DEXs like those above, onchain centralized limit order books (CLOBs) are beginning to emerge on Sei. Citrex Markets was first to go live in January 2025 and announced its points program in June 2025. Oxium followed, launching in June 2025. Monaco Protocol is next, slated to launch later in 2025. As seen in Messari’s report on Next Generation CLOBs, CLOBs are the optimal DEX architecture for capital efficiency, price discovery, and scalability. With Sei’s Giga upgrade looming, the network is perfectly primed to return to its roots and become the venue for highly performant, next-gen CLOBs.

A renewed focus on builders, creators, and contributors within the Sei ecosystem was on display in Q2 2025 with an emphasis on US-based innovation and AI builders:

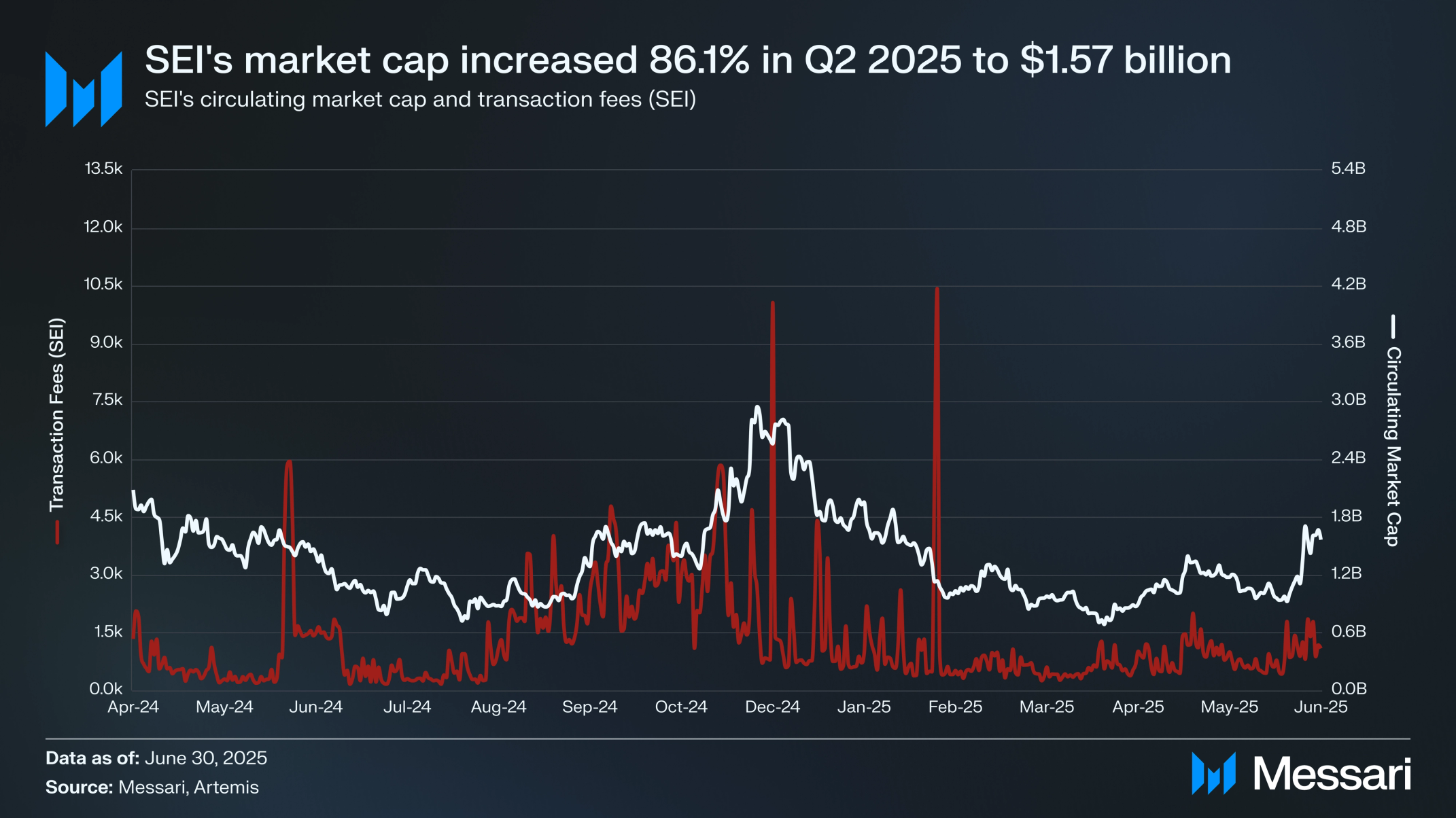

SEI’s price increased throughout the first half of Q2 2025, reaching a high of $0.27 on May 10, before dropping back down to a low of $0.16 on June 17. However, the token rallied 69.2% over the final two weeks of the quarter. Overall, SEI’s price increased 63.5% QoQ to end Q2’25 at $0.28. Meanwhile, Sei’s quarterly transaction fees (USD) increased 70.9% QoQ to $38,400, while quarterly transaction fees (SEI) increased by 93.4% QoQ to 148,900.

Due to a circulating supply increase of 13.8% QoQ to 5.56 billion, SEI’s circulating market cap increased by a larger percent, up 86.1% QoQ to $1.57 billion. However, the token’s circulating market cap rank fell from 66th to 72nd, indicating slight underperformance compared to the broader market.

Annualized inflation decreased from 5.5% to 4.8%. Combined with a 6.3% QoQ decrease in the amount of staked SEI, annualized staking APY increased from 5.1% to 5.4%, resulting in the first time Sei stakers experienced a positive annualized real yield of 0.6%.

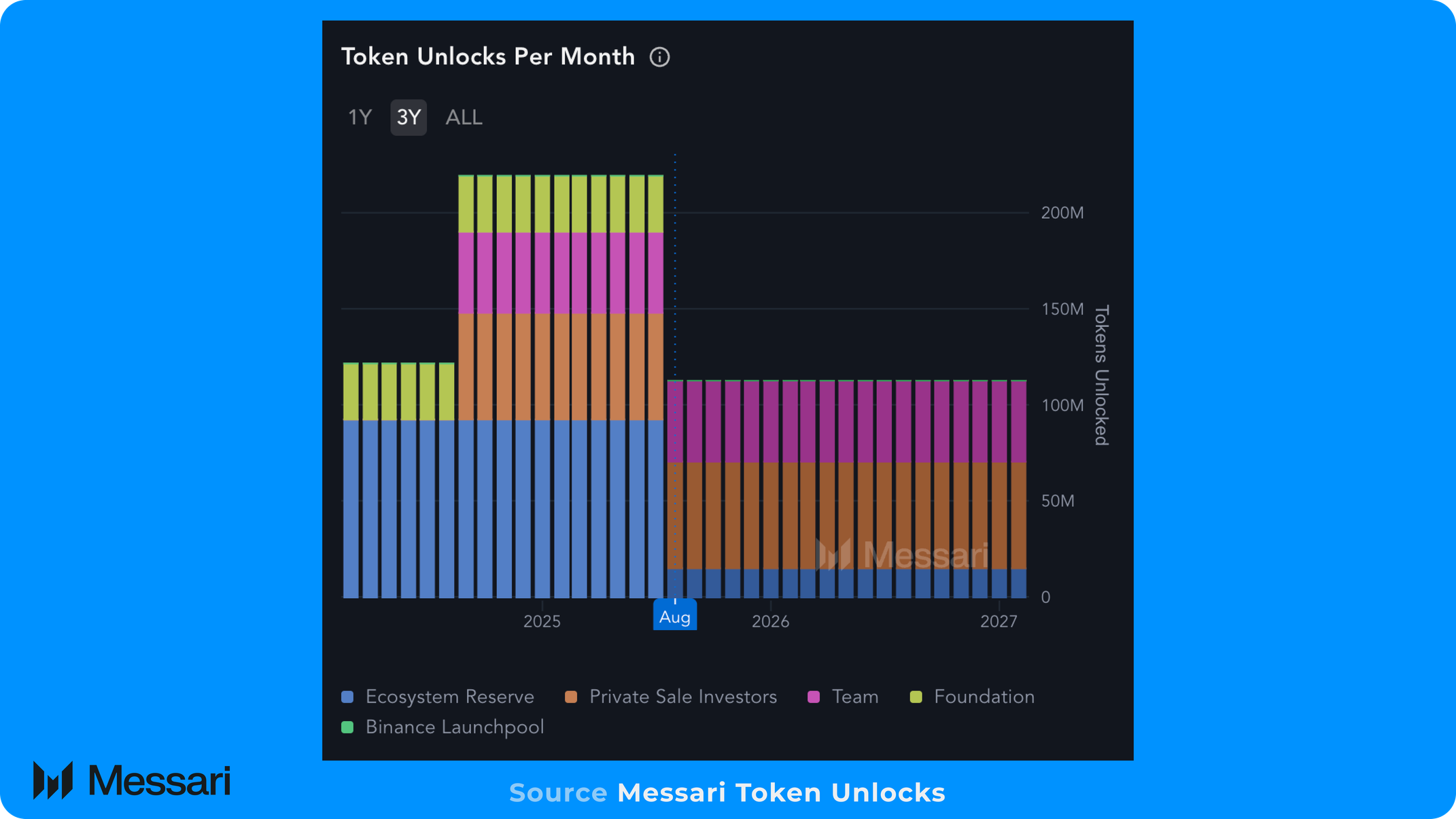

SEI’s circulating supply increased 13.8% QoQ to 5.56 billion, due to a mix of token unlocks and staking rewards. In Q2’25, 659 million SEI vested, with the investor and project team allocations vesting at a combined rate of 97.8 million SEI per month.

SEI tokens will continue to vest until Aug. 14, 2033. However, the monthly rate of vesting is set to decrease in August 2025, from 219.7 million to 113 million SEI. This change is due to the Sei Foundation’s allocation having fully vested, and the ecosystem reserve allocation’s monthly vesting decreasing from 92.7 to 15.2 million SEI.

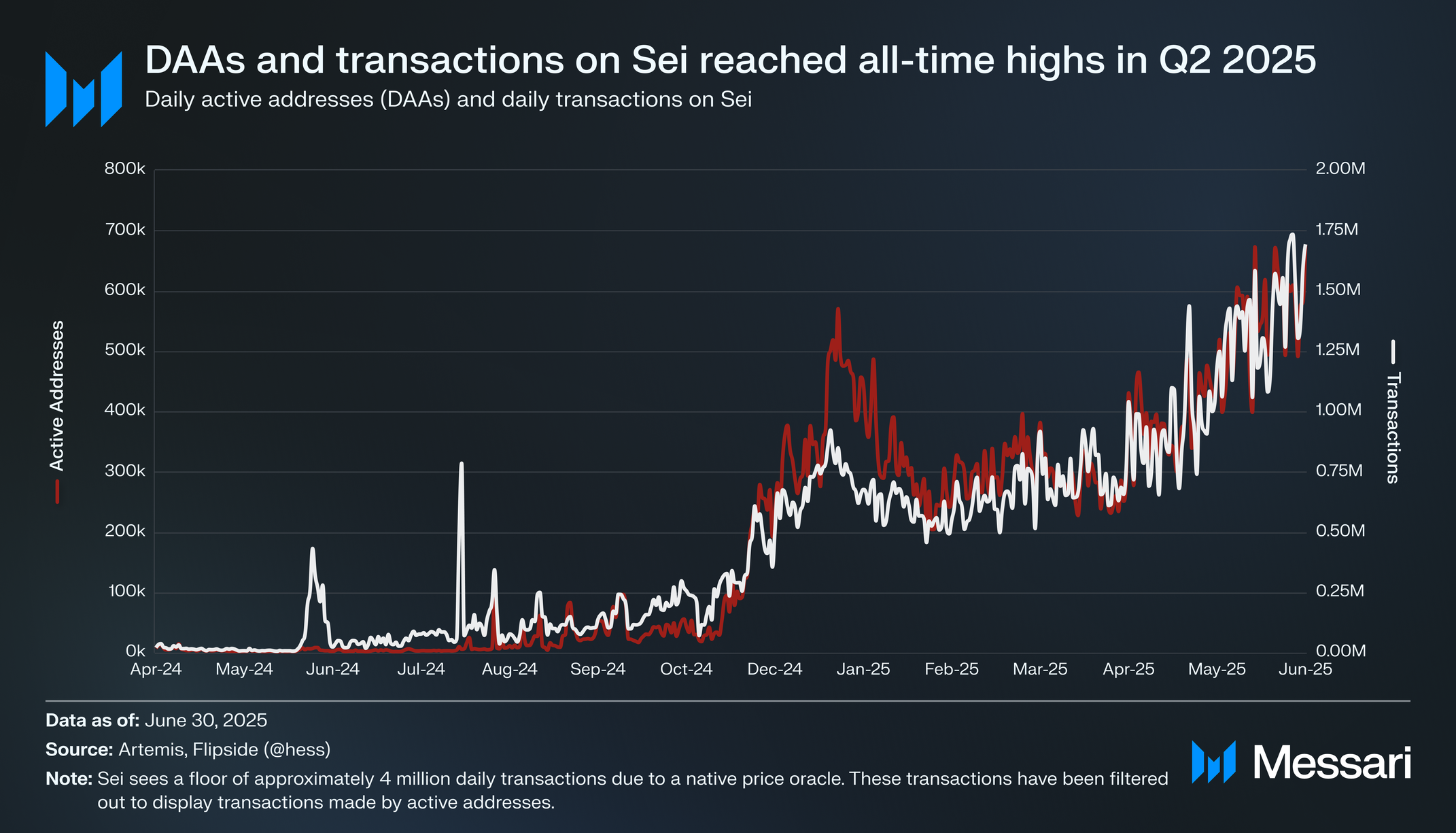

Average daily active addresses (DAAs) increased 36.6% to 426,000 in Q2 2025, while daily transactions made by active addresses increased 12.6% to 720,300. A major uptrend in DAAs and transactions began in mid-November, reaching a peak of 486,760 DAAs and 738,990 transactions on January 10. The trend stabilized in Q1’25, before continuing to new all-time highs in Q2’25. Specifically, 676,900 DAAs on June 30, and 1.73 million transactions on June 25.

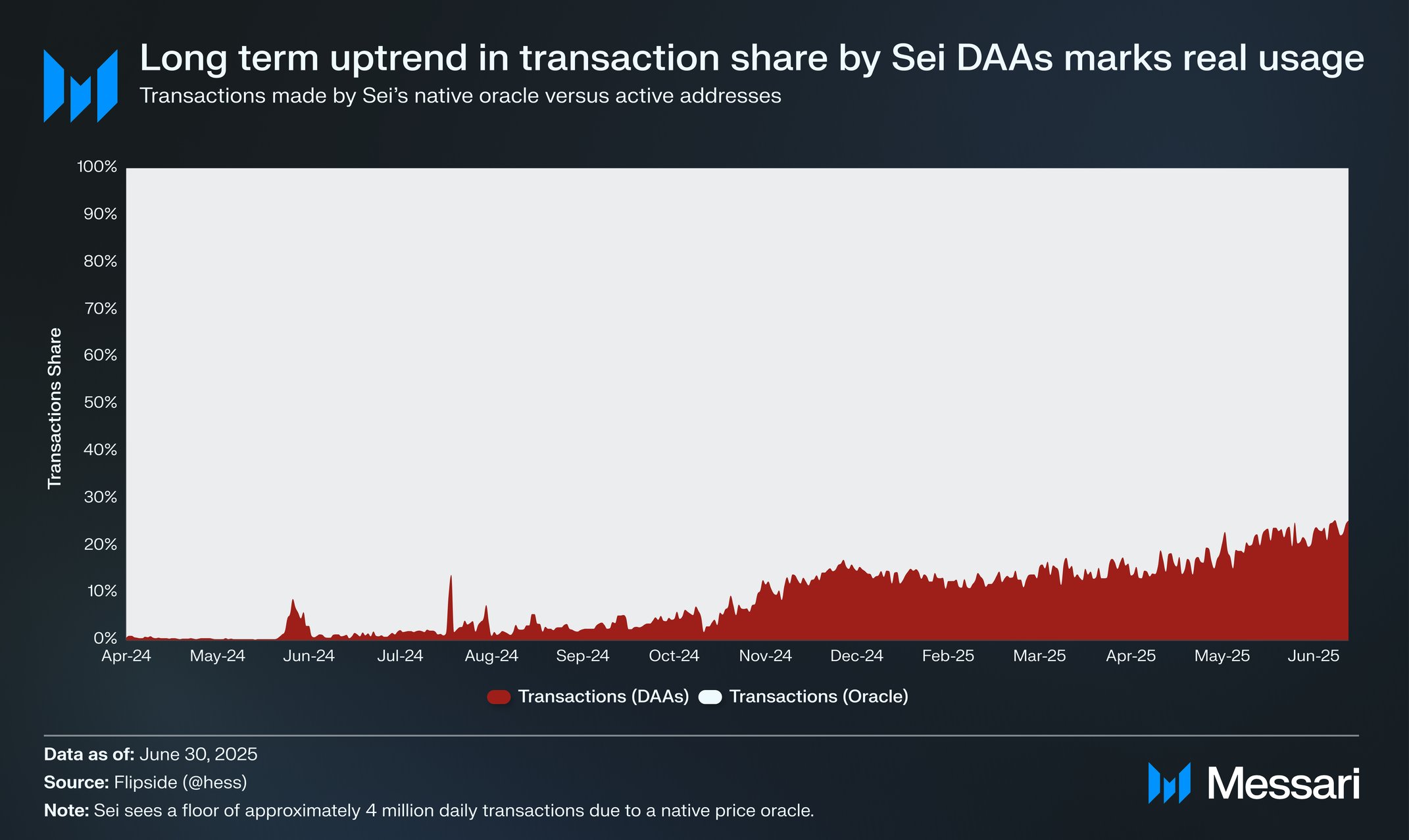

Notably, Sei sees a floor of approximately 4 million daily transactions due to a native price oracle. All validators are required to participate as oracles by sending vote transactions and providing updated price data in every other block. Filtering out these transactions leaves only transactions made by active addresses that are indicative of real users on the network.

The portion of Sei’s total transactions made by active addresses has been continually increasing. Specifically, transactions made by active addresses made up 8.8% of all transactions on Sei in Q4’24, 13.5% in Q1’25, and 19.5% in Q2’25. Overall, the positive changes in average daily transactions and DAAs show that Sei continued to grow at a rapid pace once again in Q2’25.

Sei’s total stake (SEI) decreased by 6.3% QoQ to 4.93 billion. However, combined with the aforementioned increase in SEI’s price, total stake (USD) increased 53.2% QoQ to $1.39 billion. Notably, these metrics include unvested, locked SEI tokens that can be staked to earn liquid rewards.

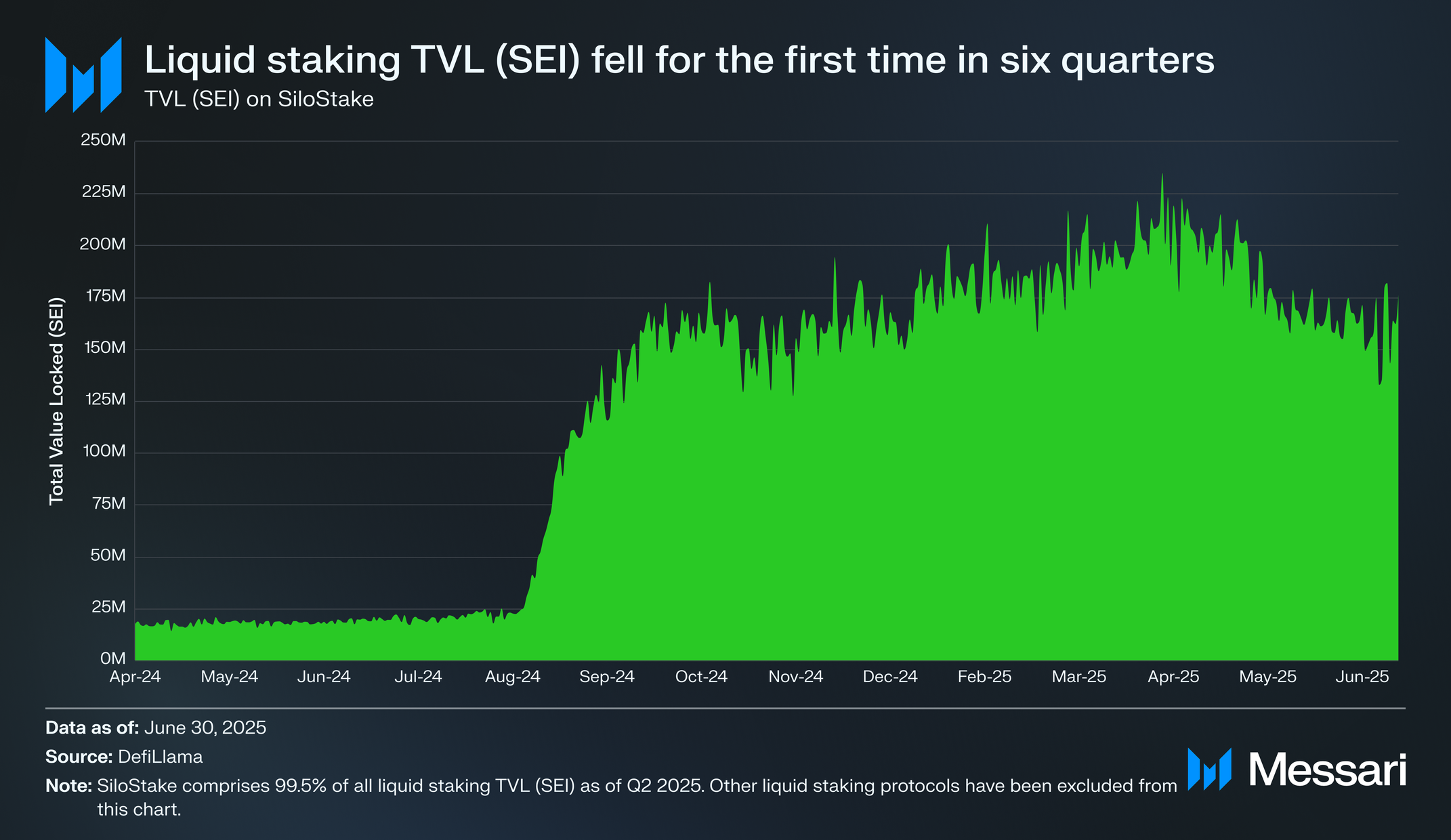

SiloStake allows users to stake SEI in return for their liquid staking token, iSEI, which can be redeemed to receive the underlying SEI after a 21-day unbonding period. As of the end of Q2 2025, SiloStake comprised 99.5% of all liquid staking TVL (SEI) on Sei, continuing to dominate as the only relevant player in Sei’s liquid staking sector.

By the end of Q2’25, 176.2 million SEI had been liquid staked with Silo, a 12.8% QoQ decrease from the 202.1 million SEI that had been liquid staked by the end of Q1’25. This was the first time liquid staking activity on Sei decreased. Compared to Sei’s total stake (SEI), the liquid staking rate fell from 3.9% to 3.6%.

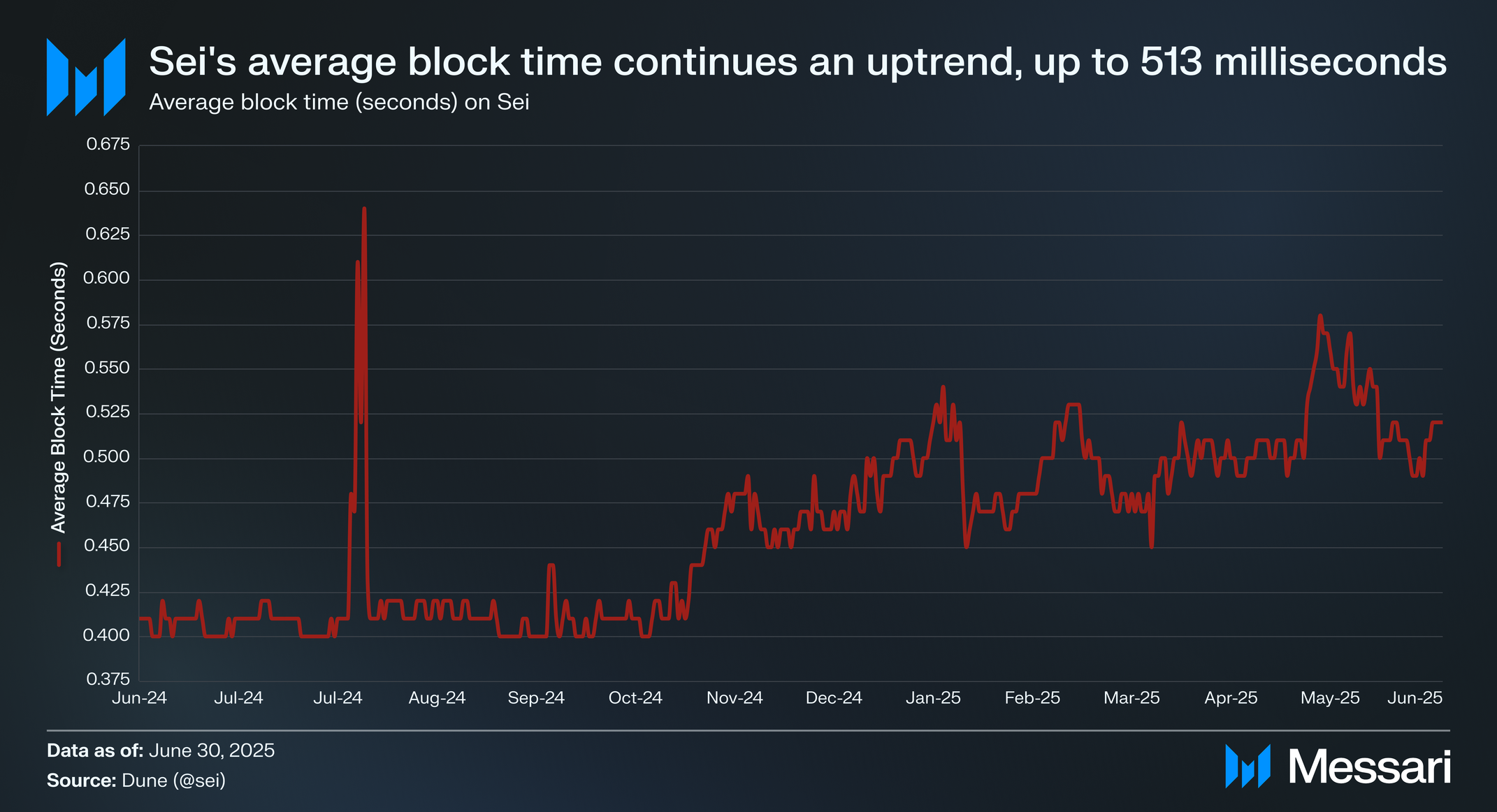

In December 2024, Sei Labs announced Giga, an in-development upgrade that plans to offer a 50x improvement in throughput over other EVM-compatible networks. Specifically, Giga aims to reach a maximum capacity of five gigagas per second. Gigagas is a measure of a blockchain’s computational capacity that replaces the commonly used measure of transactions per second (TPS). However, the anticipated maximum TPS post-Giga is approximately 200,000, with a time-to-finality (TTF) of under 400ms.

This level of performance will be achieved by revamped execution, consensus (Autobahn), and storage workstreams. Key upgrades include intelligent transaction parallelization that predicts dependencies, the decoupling of consensus over transaction ordering from transaction execution, and the introduction of the first-ever instance of multiple concurrent proposers on an EVM Layer-1 network, allowing multiple validators to propose transactions simultaneously.

In May 2025, Sei Labs published the Sei Giga whitepaper, along with updated metrics. Sei achieved 5.2 gigagas per second, approximately 148,900 TPS, and 211ms TTF in an internal devnet environment using a set of 20 validators distributed across the United States, Europe, and Asia Pacific.

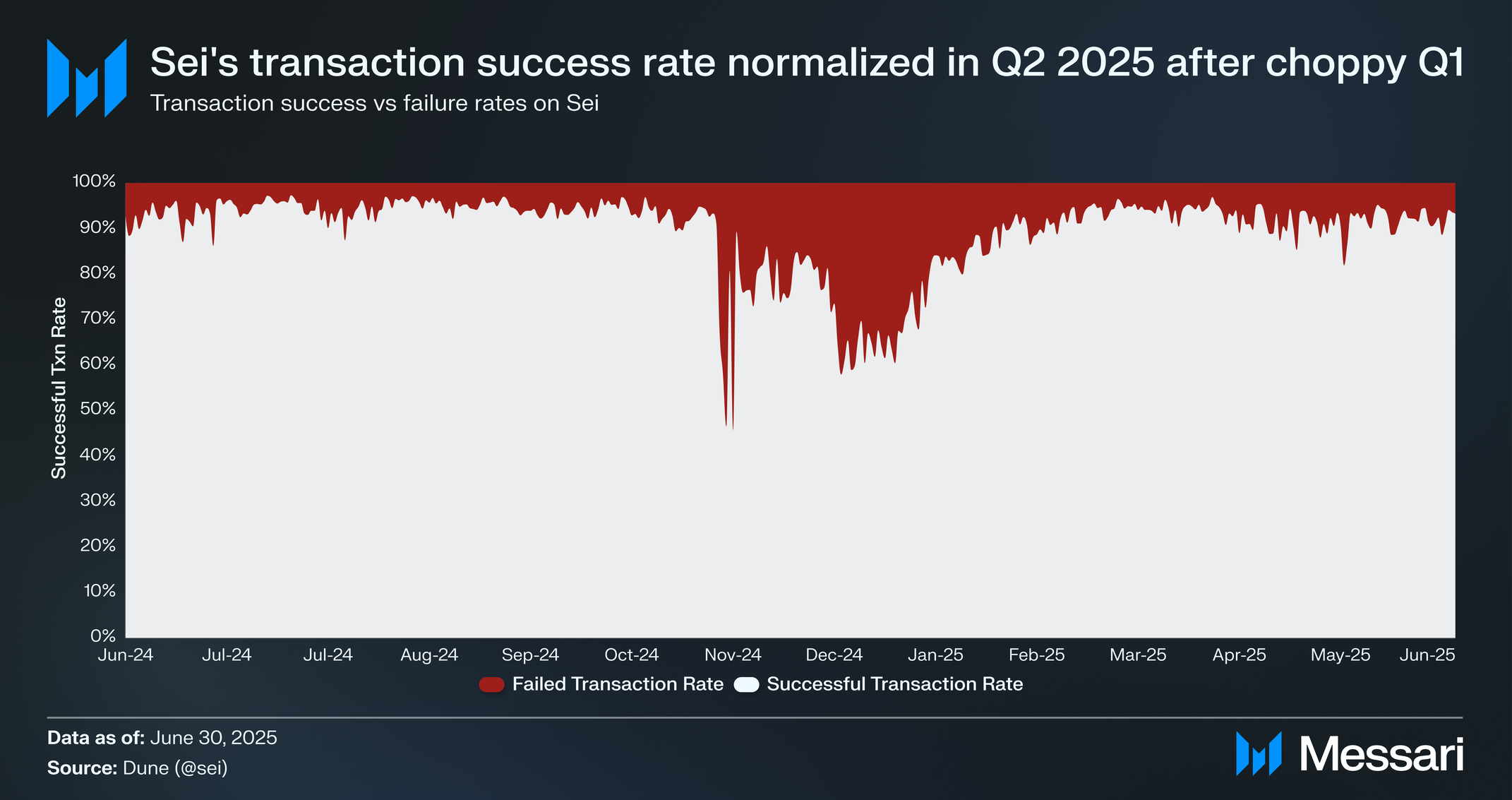

In Q2 2025, block times on Sei continued to increase, going from an average of 492ms to 513ms, a 4.4% QoQ increase. Sei also saw transaction failure rates surge in December 2024 and January 2025 to 22.7% and 29.7%, respectively. Transaction failure rates began to normalize after that period, falling to 12.5% in February and 6.4% in March, before averaging 7.7% throughout Q2’25.

In May 2025, Sei Labs introduced Sei Improvement Proposals (SIPs). SIPs aim to make network upgrades a more transparent process with increased discourse from the ecosystem and the general public. There were three SIPs introduced in Q2 2025:

Sei sustained strong momentum in Q2 2025, reaching all-time highs across multiple key metrics. Gaming remained a growth driver as daily active addresses (DAAs) increased 36.6% QoQ to 426,000 while transactions also reached record highs. DeFi TVL (USD) grew 67.8% QoQ to a peak of $609.4 million, driven by Yei Finance and Takara Lend. Stablecoin supply (USD) climbed to $276.8 million, which was followed by Circle’s launch of native USDC on Sei. DEX activity on the network also hit new highs as average daily DEX volumes (USD) increased 52.6% QoQ to $24.6 million. Sailor and DragonSwap led the activity, the latter of which leveraged momentum to launch the DRG token.

Financially, the price of SEI rose 63.5% QoQ to $0.28, while the circulating market cap increased 86.1% to $1.57 billion. SEI stakers experienced positive real yields of 0.6% for the first time, and the network’s governance process matured with the introduction of Sei Improvement Proposals (SIPs). Meanwhile, Sei Labs continued work on the Giga upgrade, recording internal devnet benchmarks of 148,900 TPS and 211ms time-to-finality.

Looking ahead, Sei enters the second half of 2025 with tailwinds from an upcoming monthly token vesting reduction, a potential Canary Capital ETF approval, and the launch of Giga. These catalysts, combined with a growing ecosystem of builders and users, have led to Sei becoming one of the top Layer-1 networks primed for continued momentum.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by the Aster Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.