Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Sia (SC) is a decentralized cloud storage network that combines a Proof-of-Work (PoW) blockchain with a contract-based storage model. Storage contracts uphold storage agreements between hosts (storage providers) and renters (storage consumers). Renters define the amount of data to be stored, the timeframe for storage, and the price. Users and storage providers enter into storage contracts and deposit the native asset, Siacoin (SC), into an escrow account. Storage providers must cryptographically prove they are hosting the required data, and if they do not uphold the storage contract, their collateral is slashed. At contract expiry, the storage provider receives most of the escrowed funds, with a small portion (4%) going to holders of Siafund (SF) tokens. Siafunds are security tokens that accrue SC to the SF holder from finished contracts on Sia.

Siacoin can be used to pay for transaction fees on the Sia blockchain and as the medium of exchange for the storage market. Renters pay a storage fee, upload/download bandwidth prices, and gas to create storage contracts. Encryption ensures that uploaded files remain private, and redundancy ensures security by sharding files. Files uploaded to Sia are split into 30 shards, or chunks, and sent to various hosts. Only 10 shards are required to rebuild the file, and their copies are re-duplicated to new hosts whenever one is offline. For a full primer on Sia, refer to our Initiation of Coverage report.

Research Contents

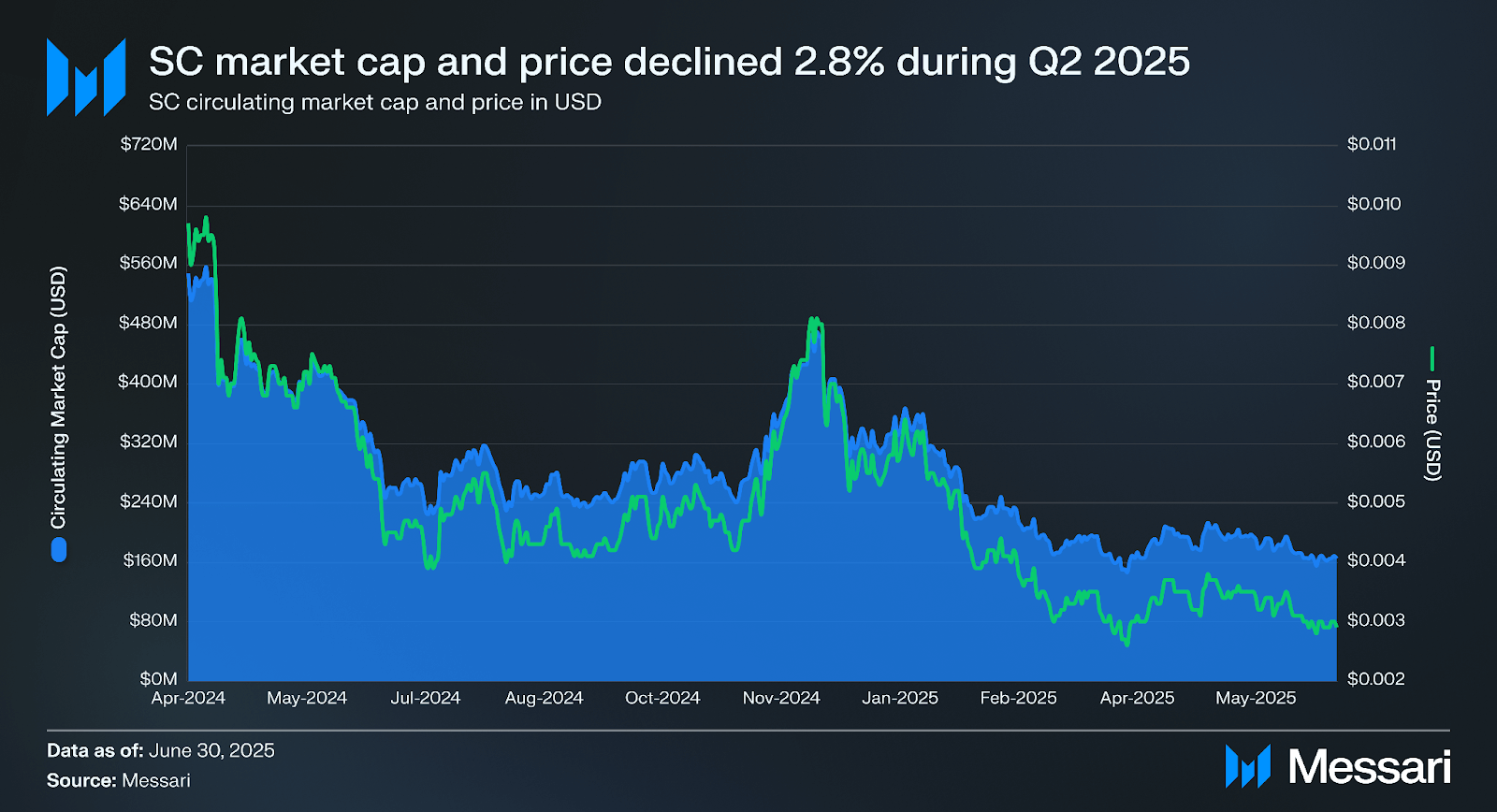

The price of SC fell 2.8% QoQ from $0.0030 to $0.0029 in Q2 2025. The circulating supply, which is generated through ongoing mining rather than token unlocks or vesting schedules, remained constant, resulting in the circulating market cap also declining 2.8% to $164.8 million. SC’s market cap rank decreased from 198th to 234th, indicating underperformance of the broader market.

Siacoin (SC) is the native token of the Sia network, used to facilitate decentralized cloud storage. Specifically, SC is employed to (i) pay for encrypted peer-to-peer storage through file contracts, (ii) incentivize hosts and serve as collateral for reliable data retention, and (iii) distribute block rewards to miners for securing the network.

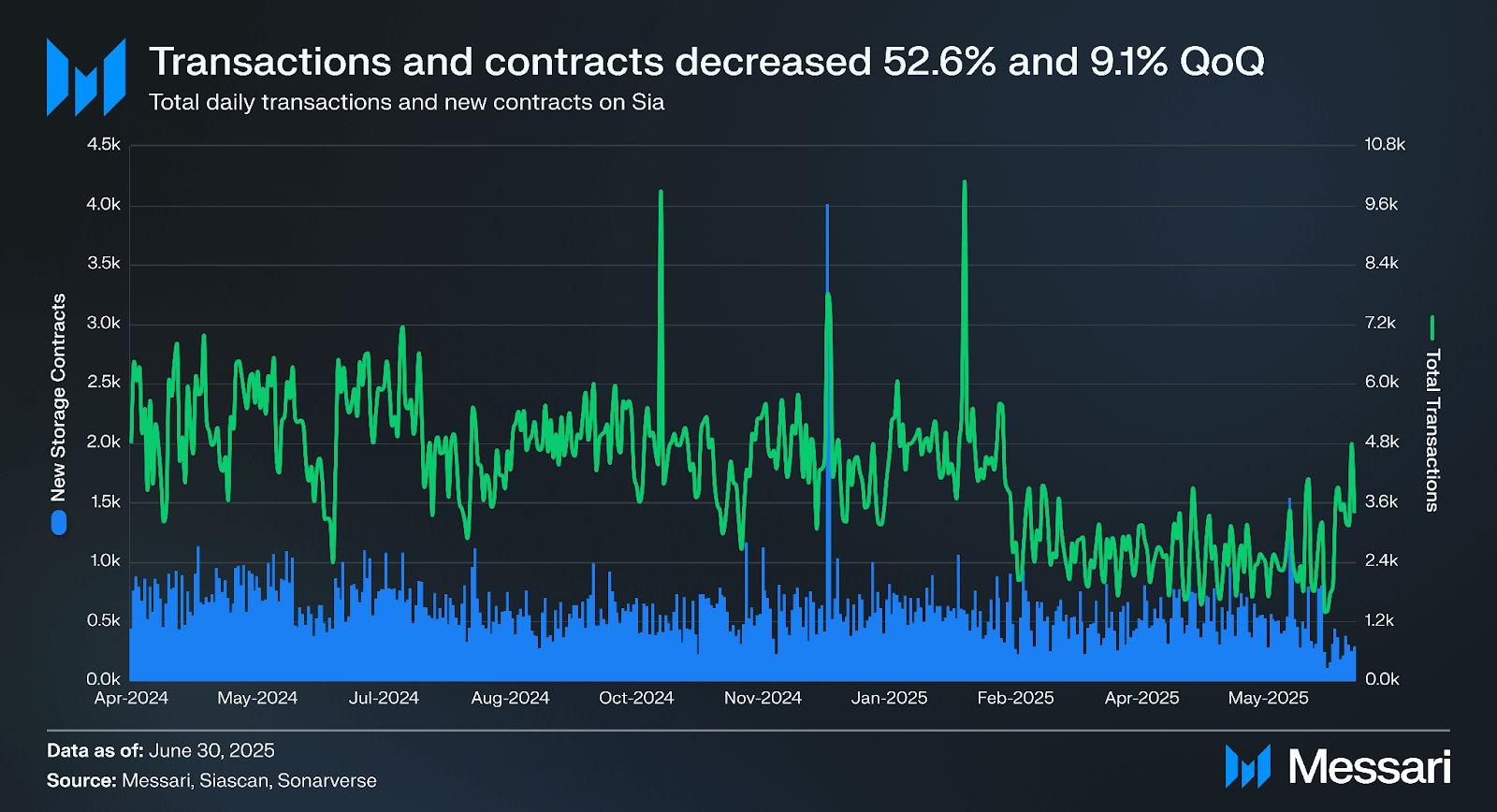

Network activity on Sia decreased further in Q2 2025, extending the slowdown that began earlier in the year. Daily transactions averaged 1,821 during the quarter, a 52.6% decline from the 3,878 in Q1’25. New storage contract creation also fell, averaging 524 contracts per day, down 9.1% from the prior quarter’s 576.

New storage contracts are a key indicator of demand generation on the Sia network. They are initiated when renters allocate a prepaid budget known as an allowance. This allowance reflects the maximum amount of SC the renter is willing to spend for storing data across multiple hosts and is calculated by multiplying the storage price (in SC per terabyte), the total data volume, and the intended storage duration.

For instance, storing 2 TB of data for two months at a rate of 500 SC per TB would require an allowance of 2,000 SC (2x2x500). In addition to the allowance, renters pay contract formation and upload bandwidth fees at the time of contract initiation.

Hosts, in turn, are required to lock up collateral, which can be slashed if they fail to uphold the terms of the agreement, ensuring a financial incentive for uptime, data availability, and contract integrity. This structure underpins the economic foundation of Sia’s decentralized storage marketplace.

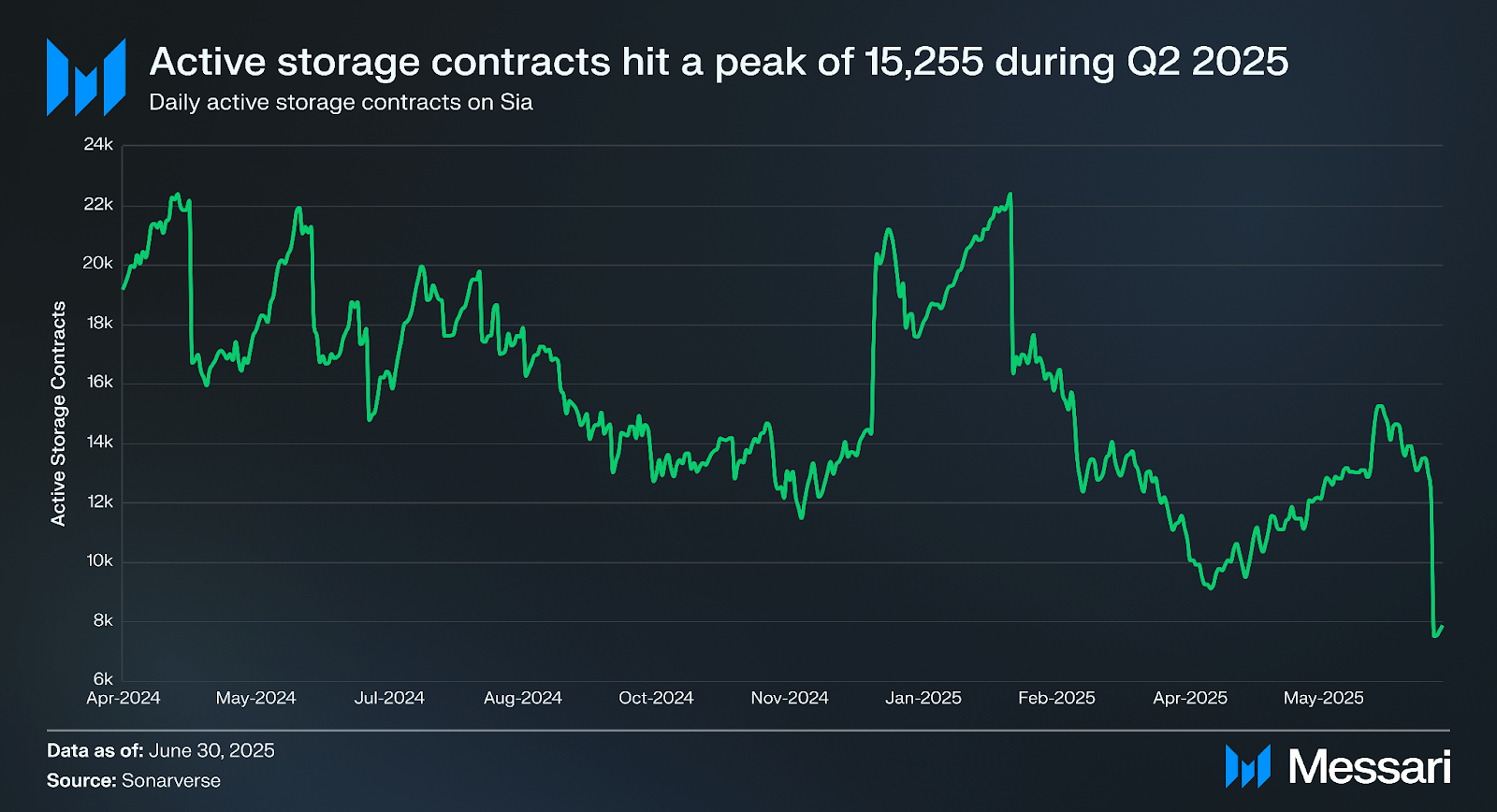

Q2 2025 saw a decline in the average number of active storage contracts on the Sia network. Active contracts averaged 21,482 during the quarter, down 38.3% from Q1’s 34,806. Both new and active contracts contracted, though the sharper drop in active contracts points to shorter contract lifetimes and higher churn relative to new demand. Activity trended lower through most of the quarter, though the successful activation of the v2 hard fork in June provided a foundation for future stabilization. While user engagement softened during the transition, the upgrade’s scalability and usability improvements position the network for stronger contract retention and renewal in subsequent quarters.

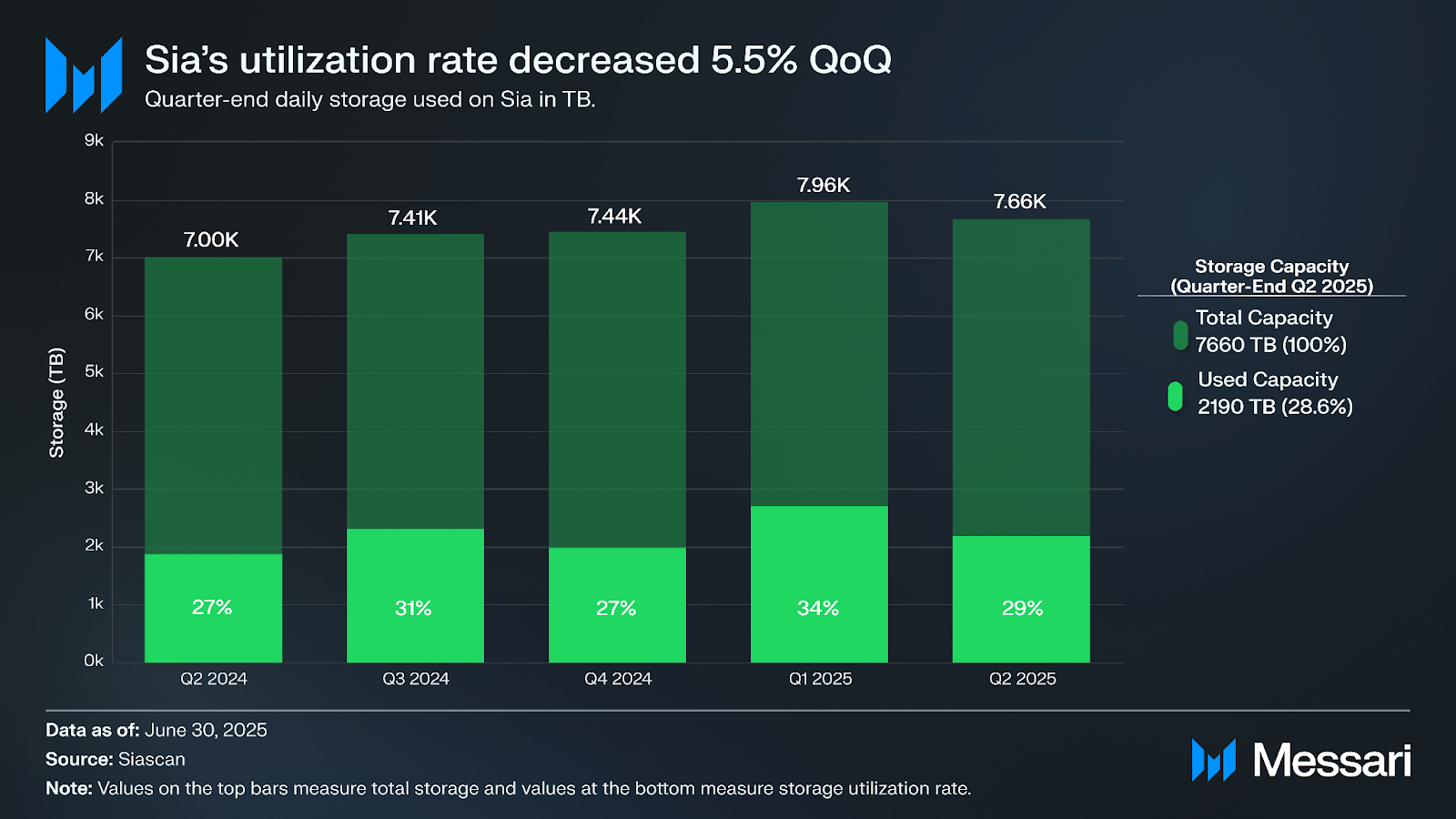

After a strong rebound in Q1’25, storage utilization on Sia pulled back in Q2 2025. Total data stored declined to 2,190 TB from 2,710 TB in the prior quarter, a 19.2% decrease. Meanwhile, total available storage capacity decreased to 7,660 TB, down from 7,960 TB in Q1. This combination resulted in a utilization rate of 28.6%, down from the five-quarter high of 34% reached in Q1’25.

The decline indicates softer renter demand during the quarter, with reduced data uploads outpacing the modest contraction in supply. Unlike Q1’25, where infrastructure upgrades and ecosystem grants drove adoption tailwinds, Q2’25 reflected a more muted environment despite the successful v2 hard fork in June. With scalability and usability enhancements now live across the network, utilization trends in the coming quarters will offer a clearer view into whether the upgrade can support renewed renter activity and more efficient conversion of supply into active storage.

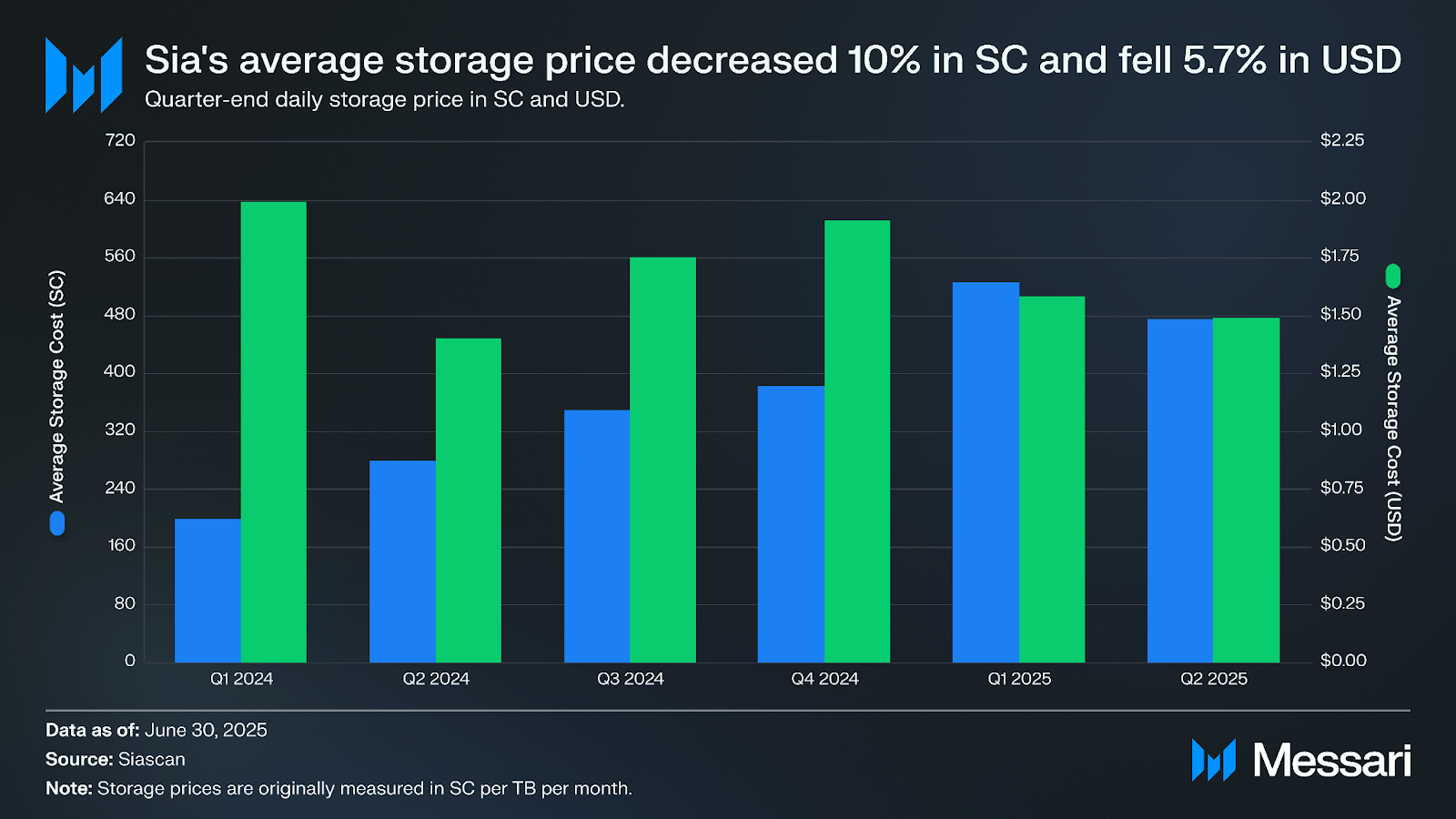

In Q2 2025, the average storage cost on Sia declined to 474.3 SC per TB/month, a 10% decrease from 526.7 SC in Q1’25. When denominated in USD, average costs also fell, dropping from $1.58 in the prior quarter to $1.49. The parallel decline in both SC and USD-denominated costs reflects a normalization in host pricing following the sharp adjustments made earlier in the year.

Unlike Q1’25, where token devaluation drove hosts to raise SC rates to preserve income, Q2’25 suggests a recalibration as demand softened and renters faced fewer upward cost pressures. The decline in utilization during the quarter further contributed to easing costs, as reduced renter activity likely limited hosts’ ability to sustain higher price points.

For renters, the environment remained favorable. USD costs reached their lowest level in five quarters, sustaining affordability amid weaker network activity. For hosts, however, the combination of lower utilization and reduced SC pricing posed ongoing revenue challenges, which set the stage for potential re-pricing dynamics as the market adjusts to post-hard fork conditions.

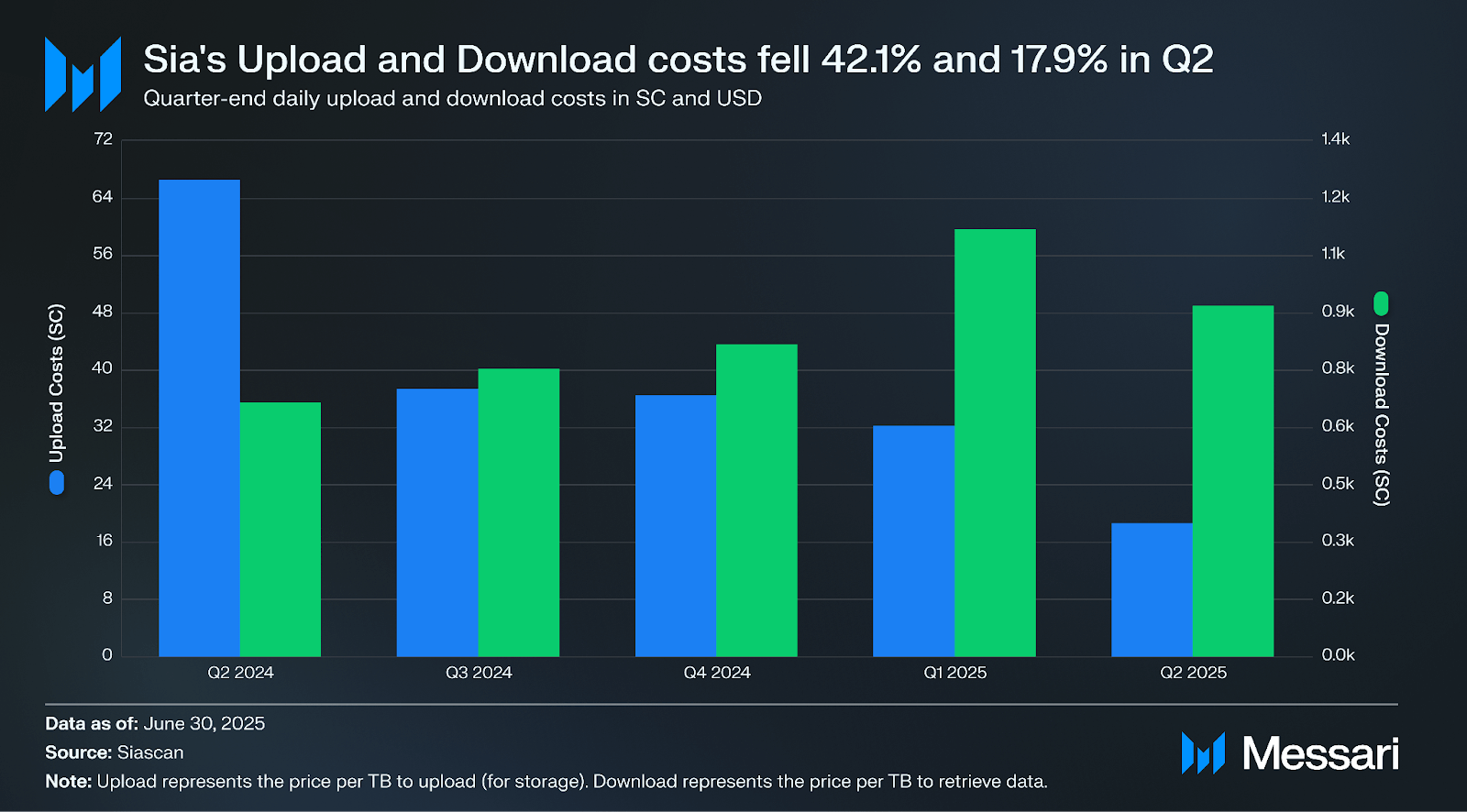

Q2 2025 showed continued divergence in Sia’s bandwidth pricing. Upload costs declined by 42% QoQ to 18.7 SC per TB, extending the multi-quarter downtrend, while download costs increased 18% to 918 SC per TB after a steep run-up in Q1’25.

The reduction in upload pricing reflects both ongoing efficiency gains within the network and weaker renter demand, which together placed downward pressure on host pricing. In contrast to prior quarters, download costs did not continue rising and instead retraced some of their earlier surge, suggesting that host pricing is beginning to normalize following the volatility seen at the start of the year.

Lower bandwidth costs, particularly for uploads, improve the network’s affordability profile and may support renter adoption in the wake of the v2 hard fork. The repricing also signals that hosts are adjusting to new performance dynamics while balancing competitive pressures in an environment of softer utilization.

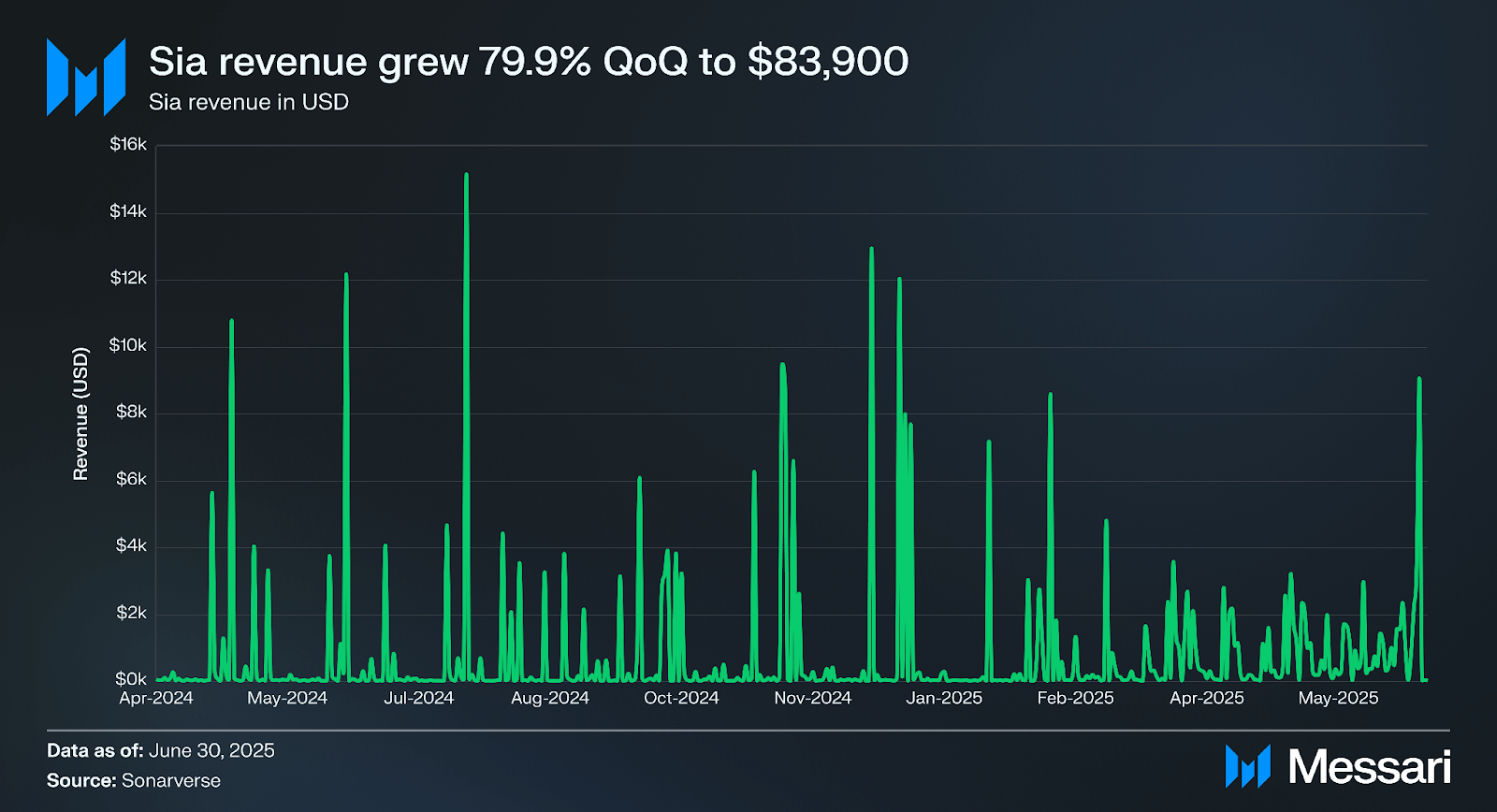

Sia’s network revenue rebounded in Q2 2025. Total revenue reached $83,900, up 79.9% from $46,600 in Q1’25. On a daily basis, this equated to roughly $922 per day compared to $518 in the previous quarter.

The recovery in revenue contrasts with broader network activity indicators, as transactions, active contracts, and utilization all declined during the quarter. This divergence suggests that while user volumes softened, pricing dynamics contributed to improved monetization for hosts. The successful rollout of v2, supported by major pools and exchanges, provides a foundation for more durable network economics in the quarters ahead, even as renter demand remains in transition.

Sia’s network revenue consists of payouts to hosts, miner fees, Siafund (SF) fees, and burned collateral. Hosts earn most of the storage-related payments, while miners capture transaction fees and block rewards to secure the network. Siafund tokenholders receive a fixed fee of 3.9% from completed storage contracts. While not directly paid to any party, burned collateral reduces Siacoin supply and is included as revenue due to its scarcity-enhancing effect on SC’s value.

On June 6, 2025 at block height 526,000, the Sia network activated its long-planned v2 hard fork, coinciding exactly with the 10th anniversary of Sia’s mainnet launch. This was the most significant update in Sia’s history, fundamentally overhauling its blockchain consensus and storage protocol. The hard fork was not backward-compatible, meaning all nodes had to upgrade to the new software. Those failing to update by the fork would fall out of consensus (unable to sync or transact) and risk voided storage contracts. Sia Foundation issued frequent reminders and documentation to ensure a smooth transition, and all major mining pools and exchanges supported the upgrade by the activation date.

Sia v2 introduced technical enhancements aimed at boosting the network’s performance, scalability, and usability. Noteworthy improvements included:

In Q2 2025, the Sia Foundation launched a comprehensive brand refresh to coincide with the V2 network upgrade and the project’s 10-year anniversary. Designed to reposition Sia for broader adoption, the rebrand emphasized user control over data and a renewed focus on privacy, security, and digital sovereignty. Moving beyond its roots as a niche crypto project, Sia now presents itself as a professional, mission-driven platform for decentralized cloud storage.

The updated brand identity reflects this philosophical shift through several key elements. A new tagline, “Safest Cloud Storage, by Design,” underscores Sia’s differentiation, decentralized architecture, encryption, redundancy, and non-profit governance, all of which contribute to a resilient and secure user experience. The redesigned logo, featuring pixel-like elements evoking encrypted data shards and exponential growth, complements the updated visual identity rolled out across Sia’s digital platforms.

Community engagement played a key role in the rebrand’s introduction. Through events like a Reddit AMA, Sia Foundation spread awareness and buy-in from its core user base. Overall, the refresh signals Sia’s evolution from a technically promising blockchain project to a polished, user-centric storage platform positioned for real-world adoption. Sustaining this momentum will depend on how effectively the new identity attracts developers, partners, and long-term users in the quarters ahead.

Beyond the hard fork and rebrand, Q2 2025 marked a period of ecosystem expansion for the network. Sia Foundation secured high-profile partnerships, launched developer engagement initiatives, and strengthened its community presence.

Sia’s Q2 2025 performance reflected a period of transition as network activity weakened, but foundational upgrades positioned the project for long-term resilience. Declines in transactions, active contracts, utilization, and storage demand signaled softer renter engagement. However, host revenues recovered on the back of shifting pricing dynamics. The divergence between usage and revenue showed mixed conditions for the quarter, where network monetization improved even as adoption metrics contracted.

At the same time, the successful rollout of the v2 hard fork and the accompanying rebrand marked a turning point for Sia. The upgrade modernized the protocol with enhanced scalability and security, while the new identity reinforced its positioning as a secure, decentralized cloud platform. Partnerships such as the HackerNoon integration demonstrated Sia’s ability to support large-scale, real-world use cases. Together, these developments suggest that while Q2 was defined by short-term headwinds, Sia has laid the groundwork for stronger adoption.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by Sia Foundation. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.