Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Velo (Velo) is an infrastructure platform that is tired of traditional finances with web3 applications. Founded in 2018, his early efforts focused on the development of digital reserves (DRS) and a digital loan mechanism to allow safe and effective cross -border settlements. By the end of 2023, Velo shifted Its focus according to a decentralized network for payment of web3 (eg Velo Finance), at the same time presenting its identity framework as an additional feature. At the end of 2024 expanded Its focus involving rwa tokenization OrbitConsumer Super app that makes it easier to pay between Web2 and Web3. So far, in 2025, Velo has evolved his Payfi narrative in Payfai by integrating artificial intelligence into his canvas infrastructure and releasing a new Payfai Litepaper.

StarryKnown for cheap and effective transactions, is the basis for the initial velne infrastructure. It supports Velo Finance and facilitates the bonds of wallets, and now serves as the primary ramp to turn on and off for users within VELO’s ecosystem. NovaVelo’s EVM-Compatibil Blockchain, allows smart contracts and supports defines surgery, mainly on the universe (Velo’s Hybrid Exchange platform). AND Bridge Allows the transfer of assets between these different blockchain.

The Loyalty Program Omni Point makes it easier to earn and buy points in the activities of Web2 and Web3 through orbit. In order to fulfill regulatory requirements with privacy preservation, the Velo -a identity frame combines KYC/KYB protocols with an anonymous blockchain layer, relying on licensed KYC/KYB process management partners.

Website / X (Twitter) / Disharmony

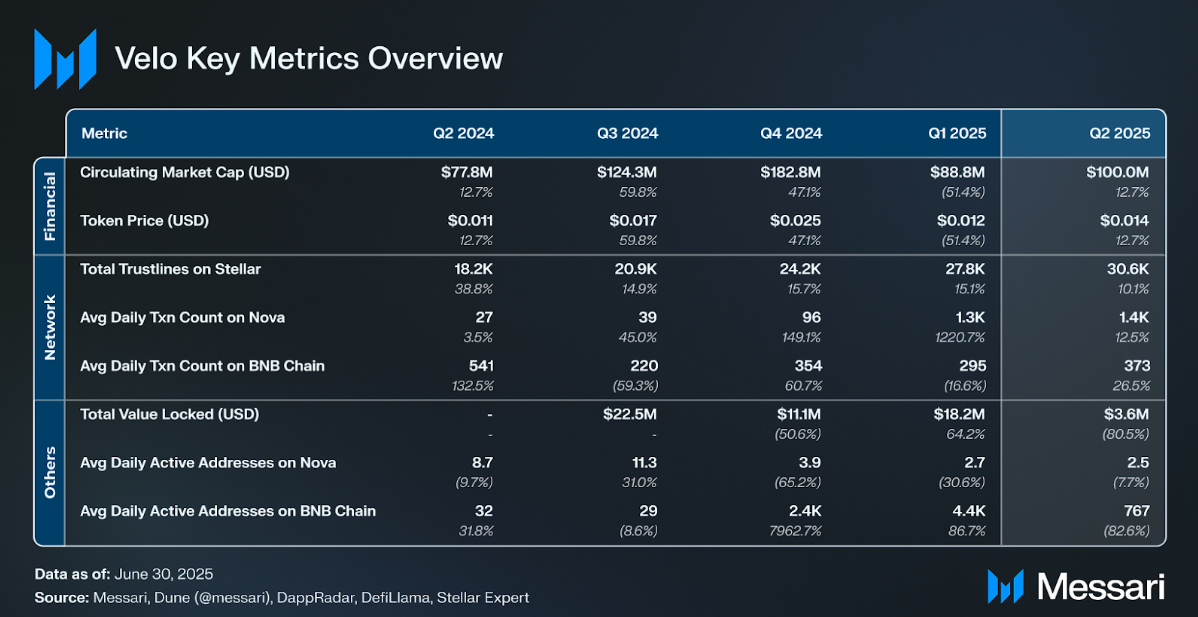

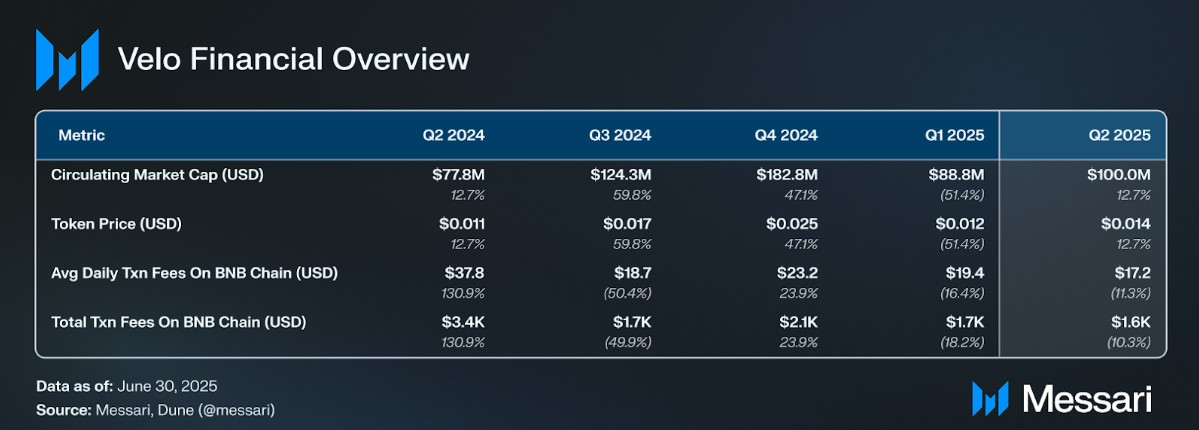

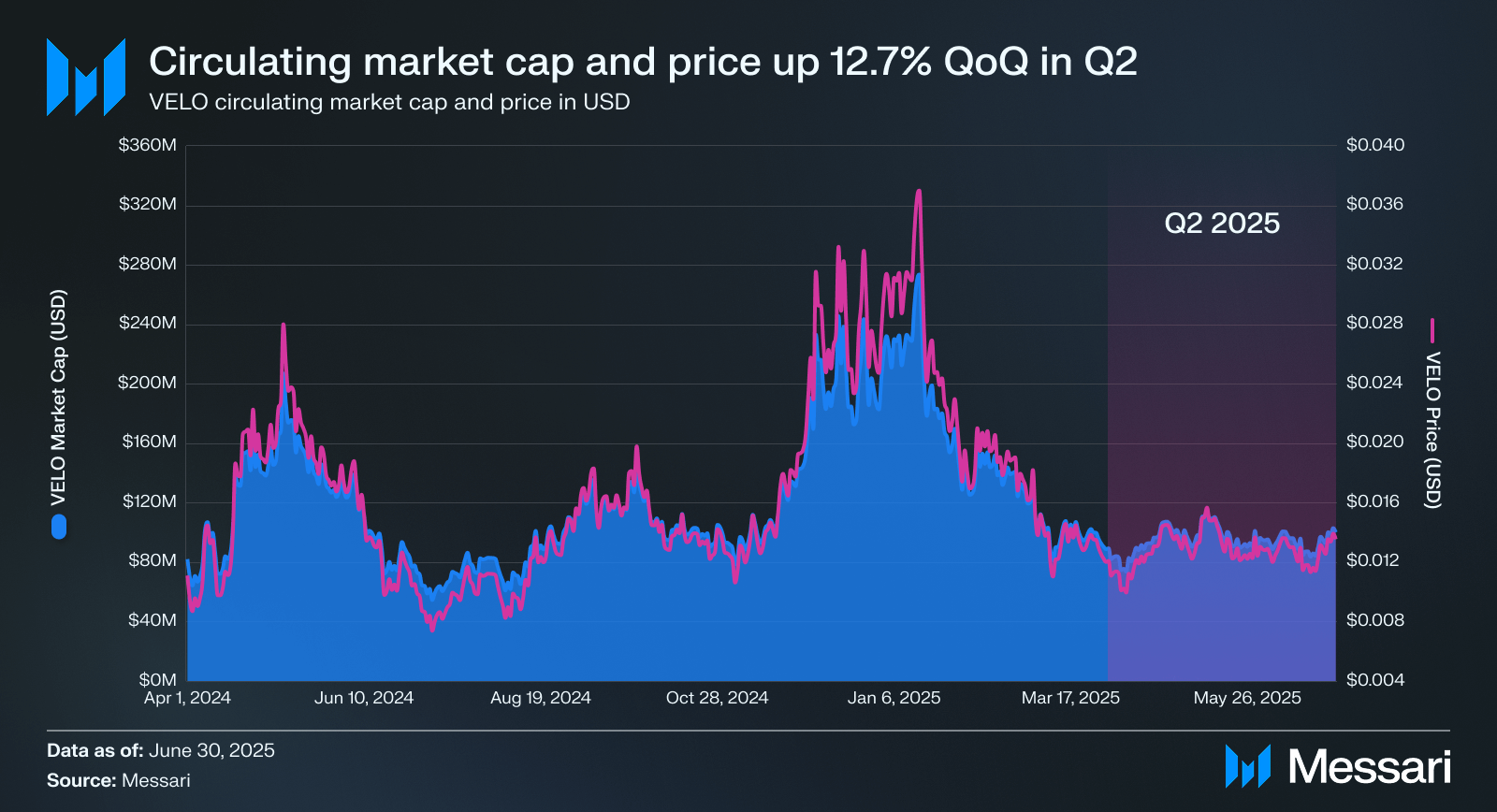

Compared to BTC and ETH, which noted that their market caps are increased by 30.3%, or 36.6% QOQ, increasing the market limit of Velo -a, increased by 12.7% QOQ, increasing from 88.7 million USD in Q1 to 100.0 million USD in Q2. The token price also increased by 12.7%, climbing from 0.012 to $ 0.014.

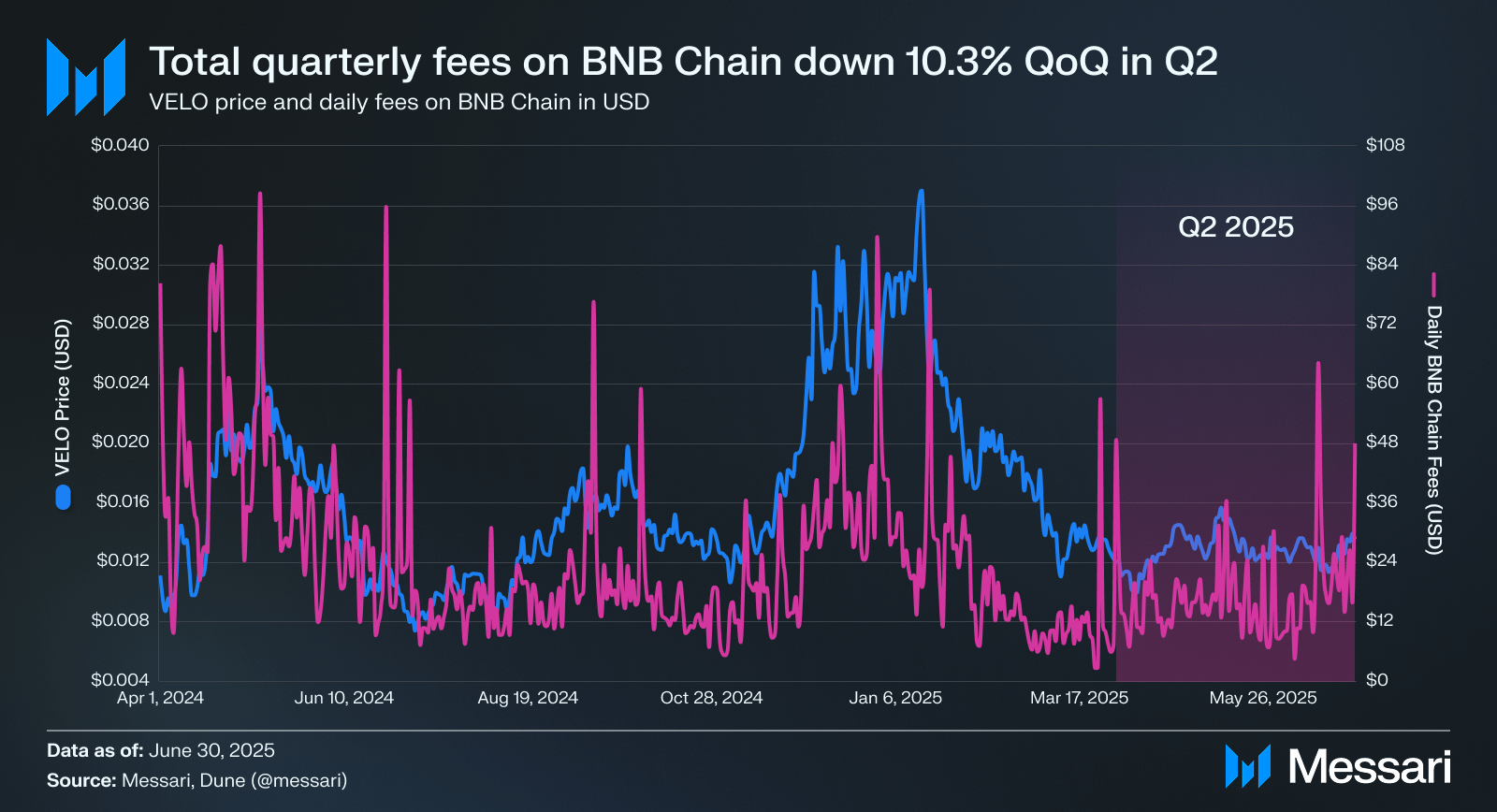

Despite Stellar is the original blockchain velo, most surgery switched to other blockchains. For example, Vero Financewhich focuses on Velo’s environment of define, acts on the BNB chain. The fees are generated and summarized through the BNB chain.

UniverseVelo’s Hybrid Exchange platform uses both new and BNB chains. Users are connected through the BNB chain, but perform internal operations to a new one until the funds are withdrawn. QuantumVelo -This remittance network, which is yet to be implemented, plans to use starry.

The new transaction fees initially been estimated by using Universe Commercial fee data; However, this approach is excluded from the QOQ calculation due to inconsistency and potential slope. As stated in Velo’s documentation, the new blockchain uses a new one as its own gas feewhich has no cash value and does not affect the total trends of QOQ fee. A comprehensive examination can be read here.

Total fees have decreased by 10.3% QOQ in Q2, reducing from $ 1,746 to $ 1,567. The average daily fees also decreased by 11.3% from 19.4 to $ 17.2 by the end of the quarter.

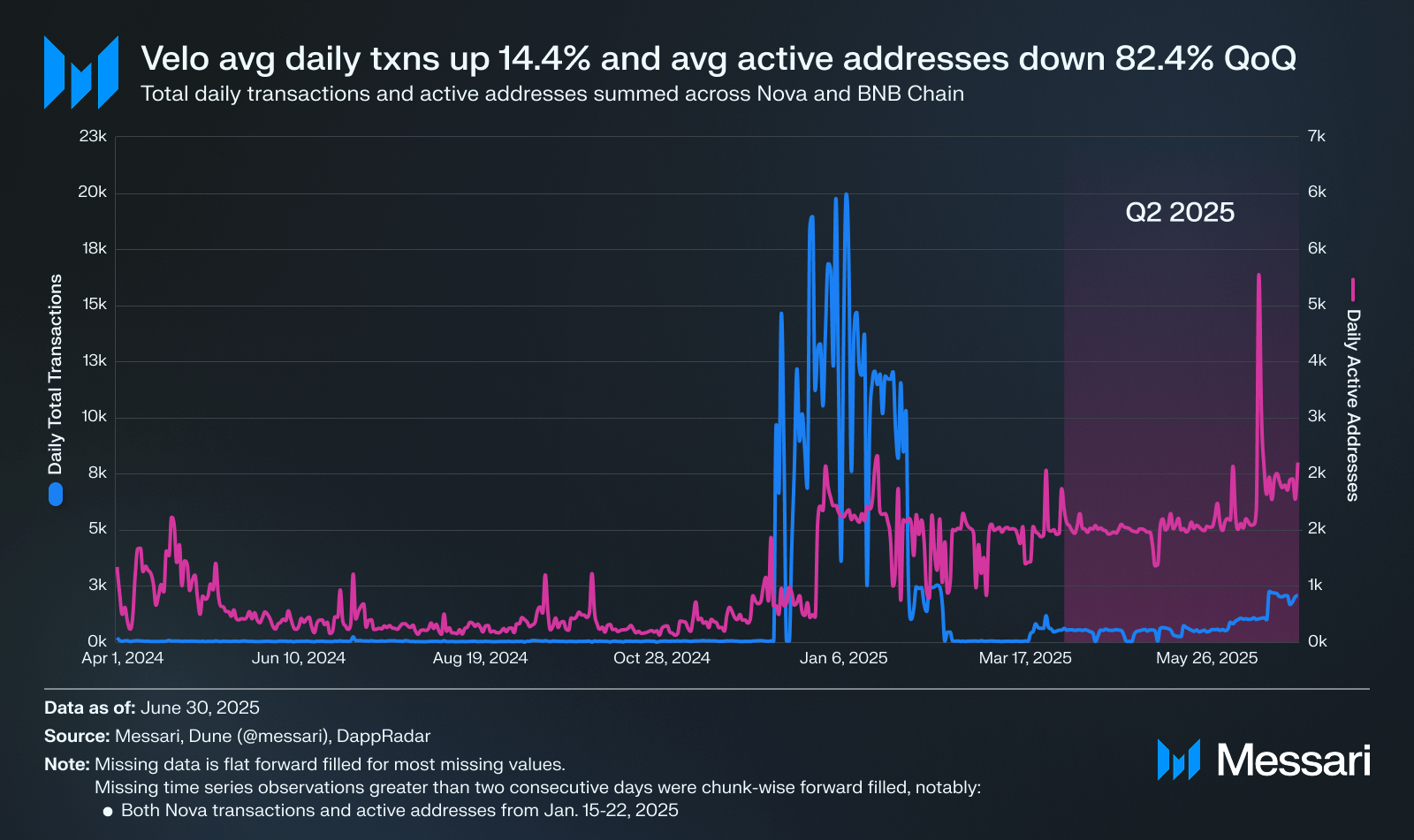

Average daily transactions in the new and BNB chain increased 14.4% QOQ, increasing from 1574 to Q1 to 1801 in Q2. In contrast, average daily active addresses have decreased by 82.4% QOQ, fell from 4364 in Q1 to 770 in Q2. The increase in transaction can be attributed to Velo Trading Competition That happened on Alfa binance. After the competition was launched on June 16, 2025, the average daily transactions on the BNB chain rose to 882 until the end of the quarter, which is 223.4% compared to the daily average of 272 quarters before the start of the competition. Increasing average daily transactions and a reduction in average active addresses indicate that, compared to Q1, the activity launched fewer users who consistently performed multiple transactions.

Breaking it chain, the BNB chain recorded 26.5% QOQ increase of average daily transactions, increasing from 295 to 373. New. Nova also recorded a 11.6% QOQ increase and average daily transactions increased from 1,279 to 1,427. In contrast, the BNB chain recorded the highest reduction in average daily active addresses, which is a drop of 82.4% QoQ from 4,360 to 767. The new has been more moderate with QOQ from 19.1%, and average daily active addresses fall from 3.1 to 2.5.

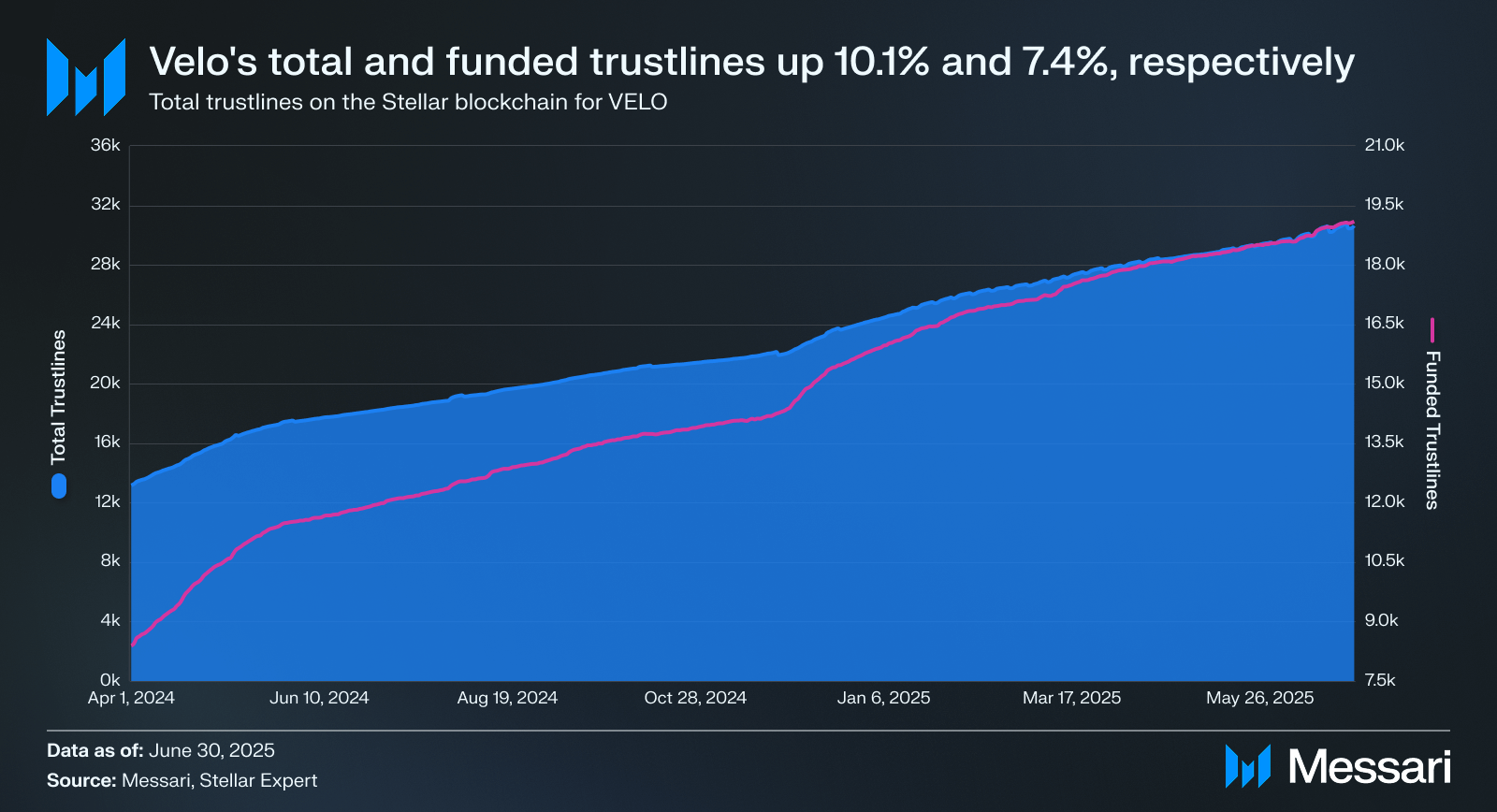

Confidence Star Agreements are between the account and the property issuer, which allows the account to be held by a transaction with a specific token. AND Funded trust Indicates active use by maintaining non-nulte balance. It is important to note that Velo Quantum network for remittances – The expected basic initiator for trust activity – is yet to be implemented.

In the Q2, the total line of trust increased 10.1% QoQ, increasing from 27.8k to 30.6K, while the funded trust increased by 7.4%, increasing from 17.8k to 19.1k. Although more moderate than in previous quarters, this continuous growth shows a permanent engagement of users with stellar property.

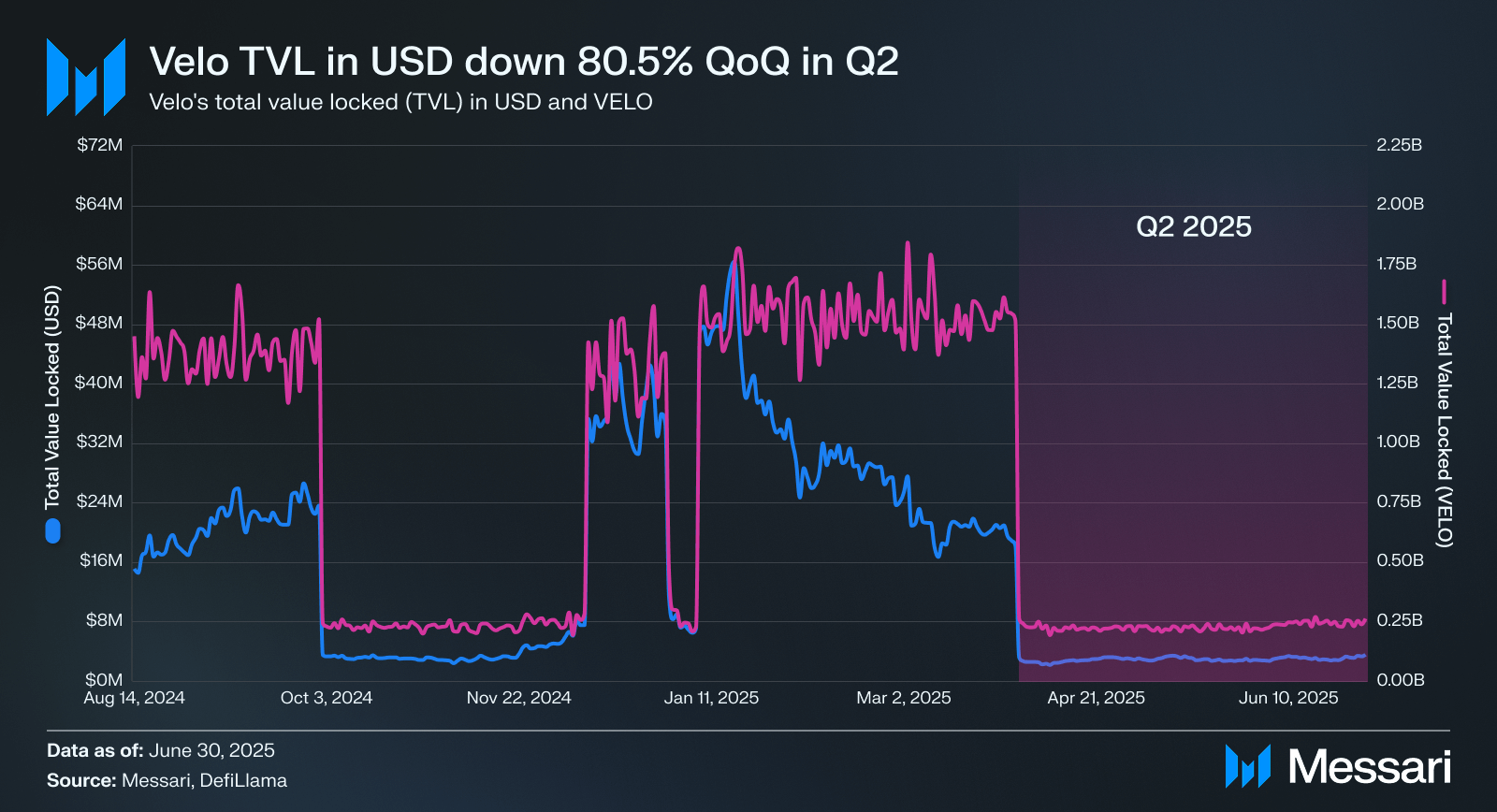

VELO’s US denominated TVL reduced 80.5% QoQ, dropped from $ 18.2 million to $ 3.6 million, and Velo-Denomated TVL decreased by 82.7%, dropped from 1.5 billion Velo to 262.4 million Vela.

It is significant that on April 1, 2025. The TVL is a denomined USD (-82.7%) from $ 18.2 million to $ 3.1 million after 1.1 billion pools to enter Velo ended the day earlier. After this fall, TVL recovered at USD 12.8% in the rest of the quarter.

Velo saw the significant development of ecosystems in Q2 in relation to limited events in Q1. These events fall apart monthly below.

April:

May:

June:

May 19, 2025, Velo announced Cooperation with Paxos Internationalregulated blockchain infrastructure and platform for tokenization, to integrate dollars to lift (USDL) in Velo ecosystem. The USDL is a stable tree, attached to the US dollar, issued by Paxos International, and regulated by regulatory bodies for financial services (FSRA) from the Global market of Abu Dhabi (ADGM). Paxos International is investing in short -term American treasuries and monetary equivalents to support USDL, distributing interest generated to owners. USDL will be integrated as reserve collateral support for USDV, the primary stable ecosystem of Velo and as a payment assets. USDV is excessively chopped USDTVelo, Openedenov Tokenized cash register accounts in the United States (Ban,, Blackkock’s USD Institutional Digital Liquity Fund (Offered) and truthusd (Tusd). The USDL integration adds additional collateral that supports the USDV Support Treasury and provides companies in the VELO ecosystem to hold a stable tree-management tree.

Velo also posted a New Litepaper On June 12, 2025, introducing a new tokenomic model for its Payfai frame that includes advisers of AI token management agent.

Litepaper redefines the role of Velo in the ecosystem by expanding its usefulness for holders and tenants, including: access to new features, applications and partnerships before public publication and rapidly accumulation of loyalty points in the Loyalty Program Velo omni Point. It is significant that the Litepaper also introduces a combustion and growth system that allows Velo Token to vote for token burns to reduce the supply of veil, potentially increase the value of the veil.

Three new entities were also established: (I) Community Management Management Management Management Fund and incentive to participate; (ii) a reserve car management foundation and USDV stability; and (III) Fund for the development of ecosystems to encourage the growth and innovation of ecosystems.

The wider cryptocurrency market has noted significant growth in Q2, with the BTC and ET -ET markets increased 30.3%, or 36.6% QoQ. Vela performance was reflected more modest profits, as its market border increased 12.7% QoQ to $ 100.0 million.

The use of the network presented mixed trends. Average daily transactions in Novi and BNB chain increased 14.4% QOQ, largely guided by a competition launched on Binance Alpha 16th, June, which led to an increase in average daily transactions 223.4% in the BNB chain by the end of the quarterly, and 38.1% increase in both chains. According to the chain, the BNB chain recorded 26.5% QOQ increase in daily transactions, while the new recorded an increase of 11.6%. Despite the increase in transactions, average daily active addresses have decreased by 82.4%QOQ, with active addresses on the BNB chain decreased by 82.4%and active addresses to a new fall 19.1%. The total fee in the BNB chain also reduced QoQ, dropped $ 10.3% to $ 1,567, and the average daily fee reduced 11.3% to $ 17.2.

TVL decreased significantly during the quarter, with USDL-Denominated TVL fell $ 80.5% QoQ to $ 3.6 million and Velo-Denomated TVL lowered 82.7% QOQ to 262.4 million Velo. The reduction primarily attributed the conclusion of the large investment pool at the end of Q1. After this event, USDL-Denomated TVL recovered by 12.8% to the rest of the quarter.

Development activity increased during Q2. The key initiatives included the launch of phase 2 of the Space Competition, the commercial competition on Binance Alpha and the partnership with Paxos International to integrate USDL as a reserve collateral for the USDV. In addition, Velo has released a new Liteper, which presented a new tokenomics model for his Payfai initiative, which integrates the combustion and earning tokens mechanism and expanded their benefits for owners and attitude.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

This report was ordered by Velo Labs Technology Limited. All content was produced independently by the author (s) and does not necessarily reflect the opinions of Messari, Inc. or an organization who requested a report. The release organization may contribute to the content of the report, but Messari maintains editorial control over the final report to retain the accuracy and objectivity of the data. The author (s) can hold the crypto currency named in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. The effect of any property so far does not indicate future results. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.