Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The crypto market is down today, with the cryptocurrency market capitalization decreasing by 1.1%, now standing at $3.95 trillion. Almost 90 of the top 100 coins have fallen in the last 24 hours. At the same time, the total volume of crypto trade is $156 billion.

TLDR:

At the time of writing, 9 of the top 10 coins by market capitalization have seen their prices decrease in the last 24 hours.

Bitcoin (BTC) down 1.2% from this time yesterday, currently trading at $114,289.

Ethereum (ETH) is down 2.1%, now changing hands at $4,120.

The highest fall in the category is 2.7%. Dogecoin (DOGE)now traded at $0.2006.

It is followed by Binance Coin (BNB). 2.2% to $1,131.

XRP recorded the category’s only increase. It is up 0.4%, trading at $2.64.

Looking at the top 100 coins, a dozen are above and the rest are in the red. Among the red coins, one recorded a double-digit fall. Pi Network (PI) fell 21.1% to the price of $0.2287.

It is followed by Zcash (ZEC)‘s 6.6% fell to $325.

On the other hand, two currencies saw double-digit growth. Figure Heloc (FIGR_HELOC) appreciated 38.8%, now changing hands at $1.36.

The other is Ivy (HBAR)which is up 16.3% at $0.2114.

Meanwhile, crypto lender Ledn has issued more than $1 billion in Bitcoin-backed loans this year. This is a sharp increase in the demand for crypto credit as investors choose to borrow instead of sell during the bull market.

In addition, Citi and Coinbase announced the plans develop digital asset payment capabilities for institutional clients. This could bring Wall Street closer to the digital asset ecosystem.

The collaboration aims to make it easier to move between fiat and crypto, and then to expand in the orchestration of payments for the settlement always.

Second to Glass nodemarkets remain cautious, while many indicators point to “stabilisation below the surface”.

In particular, sales pressure has decreased, leverage has reset, and profitability is improving, they write. That said, participation and chain activity remain muted.

“Until conviction deepens and demand expands, Bitcoin is likely to remain in a rangebound consolidation, with cautious optimism beginning to replace defensive positioning,” concludes Glassnode.

Meanwhile, Fabian Dori, Head of Investments at Sygnum Bankargues that the US government shutdown deprives investors of key economic data that help them make informed decisions about inflation trends and market positioning.

“Adding to the uncertainty are the shock waves from the recent crash of the crypto flash, which exposed fragile points that existed in the market structure and leverage in altcoins that were difficult for the stressed liquidity to absorb,” says Dori.

He argues that “this confirms, once again, the need for a complete bill of market structure, which is also affected by the political impasse”.

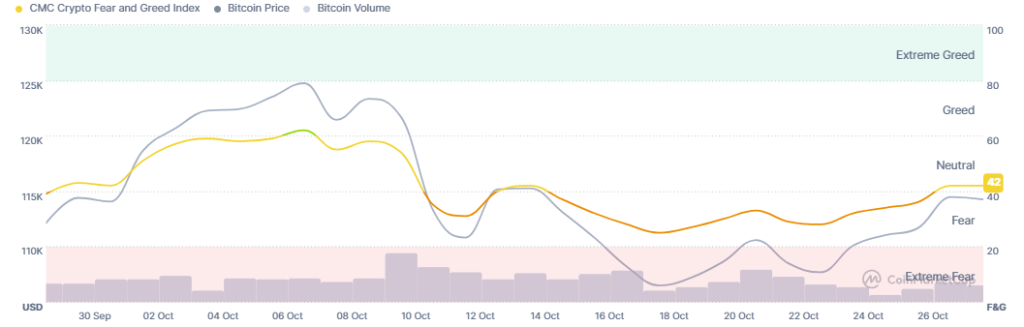

Therefore, various market indicators – including a brief drop of the fear and greed index into the territory of “fear”, the peak of Deribit’s BTC volatility index, and the average APY of loans and loans cooling from the peaks – indicate that “many investors are still digesting recent events and trying to look through the settling dust”.

“Given the constructive signals of the business cycle, the earnings of resilient companies, the accommodating liquidity and the ongoing institutional adoption of crypto, CPI readings that modestly undercut expectations and validated the Fed’s projection of a medium-term easing of inflationary pressures could help to strengthen investors’ appetite for risk,” concludes Dori.

At the time of writing on Tuesday morning, BTC is trading at $114,289. For the first part of the day, the coin traded sideways until it reached an intraday high of $115,755, before falling to an intraday low of $113,599 near the time of writing.

A break above $117,600 could lead to a move towards $120,500 and then $124,100. However, a failure to hold this level may lead to a retest of the $112,250 area.

Ethereum is currently changing hands at $4,120. Its price initially jumped to a daily high of $4,231. It then fell to an intraday low of $4,072, before recovering slightly to the current level.

If ETH moves above $4,250, it can retake the $4,400 and $4,530 levels. If the bullish trend continues, the price may proceed towards $5,000. But a fall below $4,050 could lead to a decline below the $4,000 mark and towards $3,900.

Meanwhile, the sentiment of the crypto market has not changed in the past day, it remains in the neutral zone. The index of fear and greed of crypto remains at 42 today.

The level of sentiment suggests continued caution among market participants, as they await additional geopolitical and economic signals that indicate the direction the market may take in the near to mid-term.

The US BTC spot exchange-traded funds (ETFs) registered $149.3 million in streams on Monday, for a third consecutive day. The total net outflow is now at $62.13 billion.

Of the 12 ETFs, three recorded inflows, and there were no outflows. Ark & 21 Shares took $76.4 million, followed by BlackRock $65.27 million and The gray scale $7.63 million.

In addition, the US ETH ETF broke the streak of flow on October 27, with $133.91 million in influxes. The total net outflow is now at $14.49 billion.

Six of the nine discoveries saw positive inflows, and none saw outflows. Gray scale leads the list with $72.49 million, followed by Bitwise $22.59 million.

Meanwhile, S&P Global Ratings gave Michael Saylor’s Strategy a “B-” credit rating.a level considered junk or speculative grade. It is the first Bitcoin treasury company to receive a formal credit rating from a major agency.

The firm received the rating due to its strong exposure to Bitcoin, limited business diversification and weak dollar liquidity. S&P said the outlook for the company remains stable.

The crypto market declined over the past day, and the stock market rose and set new intraday and closed ATHs during business hours on Monday. At closing time on October 27, the S&P 500 increased by 1.23%, the Nasdaq-100 increased by 1.83%, and the Dow Jones Industrial Average increased by 0.71%. Major stock indexes set records for a second consecutive session on renewed optimism that the United States and China could see a trade deal.

Analysts expect additional, intermittent drops in the market’s search for a stable base that will enable the next stage. However, we are likely to see even shorter durations in the near future.